Employer’s Guide to ACA Reporting:A Review of the Forms and Instructions for 2018

President Trump Signs Bills Aimed to Protect Consumers from Overpaying for Prescriptions

Did You Know: Tax Cuts and Job Acts

Employer’s Guide to ACA Reporting:A Review of the Forms and Instructions for 2018

As part of the Tax Cuts and Jobs Act (TCJA), the Affordable Care Act’s (ACA) individual mandate penalty has been repealed effective January 1, 2019; however, the TCJA did not repeal the employer mandate nor its reporting requirements. Employers should be prepared to respond to IRS Employer Shared Responsibility Provision (ESRP) penalty letters and continue to prepare for 2018 reporting, which will occur in the first quarter of 2019.

The IRS has released the final versions of its employer and provider reporting forms and instructions for 2018. Links to the forms and instructions are below:

- Form 1094-C: www.irs.gov/pub/irs-pdf/f1094c.pdf

- Form 1095-C: www.irs.gov/pub/irs-pdf/f1095c.pdf

- Form 1094-C / 1095-C Instructions: www.irs.gov/pub/irs-pdf/i109495c.pdf

- Form 1094-B: www.irs.gov/pub/irs-pdf/f1094b.pdf

- Form 1094-B / 1095-B Instructions: www.irs.gov/pub/irs-pdf/i109495b.pdf

<www.irs.gov/affordable-care-act/employers/questions-and-answers-about-information-reporting-by-employers-on-form-1094-c-and-form-1095-c li>Form 1095-B: www.irs.gov/pub/irs-pdf/f1095b.pdf

Additional IRS guidance can be found here:

- Forms and Instructions for Prior Years:

https://apps.irs.gov/app/picklist/list/priorFormPublication.html?resultsPerPage=200&sortColumn=sortOrder&indexOfFirstRow=0&criteria=formNumber&value=1094c+&isDescending=false - IRS Tool for Determining ALE Status and Potential Penalty Exposure

https://taxpayeradvocate.irs.gov/estimator/esrp/

Q/A’s on Reporting by Health Coverage Providers (Section 6055):

www.irs.gov/affordable-care-act/questions-and-answers-on-information-reporting-by-health-coverage-providers-section-6055 - Q/A’s on Reporting of Offers of Health Coverage by Employers (Section 6056):

www.irs.gov/affordable-care-act/employers/questions-and-answers-on-reporting-of-offers-of-health-insurance-coverage-by-employers-section-6056 - Q/A’s about Information Reporting by Employers on Form 1094-C and Form 1095-C:

www.irs.gov/affordable-care-act/employers/questions-and-answers-about-information-reporting-by-employers-on-form-1094-c-and-form-1095-c - Q/A’s on Employer Shared Responsibility Provisions Under the ACA:

www.irs.gov/affordable-care-act/employers/questions-and-answers-on-employer-shared-responsibility-provisions-under-the-affordable-care-act

This guide reviews the 2018 forms and instructions and notes relevant changes from 2017. It also addresses IRS guidance on the solicitation of social security numbers (“SSNs”) or taxpayer identification numbers (“TINs”) and the treatment of cash “opt-out” payments for reporting purposes. It also provides guidance for employers that receive Letter 226J, Notice of a proposed Employer Shared Responsibility Payment, or Letter 5699, Request for ACA Reporting Forms.

The reporting requirements are complex, due in part to how the health care reform law was drafted. The Affordable Care Act added two sections to the Internal Revenue Code: Sections 6055 and 6056. The sections are found next to each other in the Code; however, they apply to different types of entities. Section 6055 applies to providers of health insurance, such as health insurance carriers and employers that sponsor self-insured plans. Section 6056 applies to “applicable large employers” or “ALEs”, which are employers with 50 or more full-time equivalent employees in the prior calendar year.

To further complicate things, the reporting forms come in two different “series” – the B-Series and the C-Series forms. Employers may use either or both sets depending on their company size and whether their group health plan is self-insured or fully insured. Our goal with this guide is to provide some clarity and best practices for employers.

Links and Resources

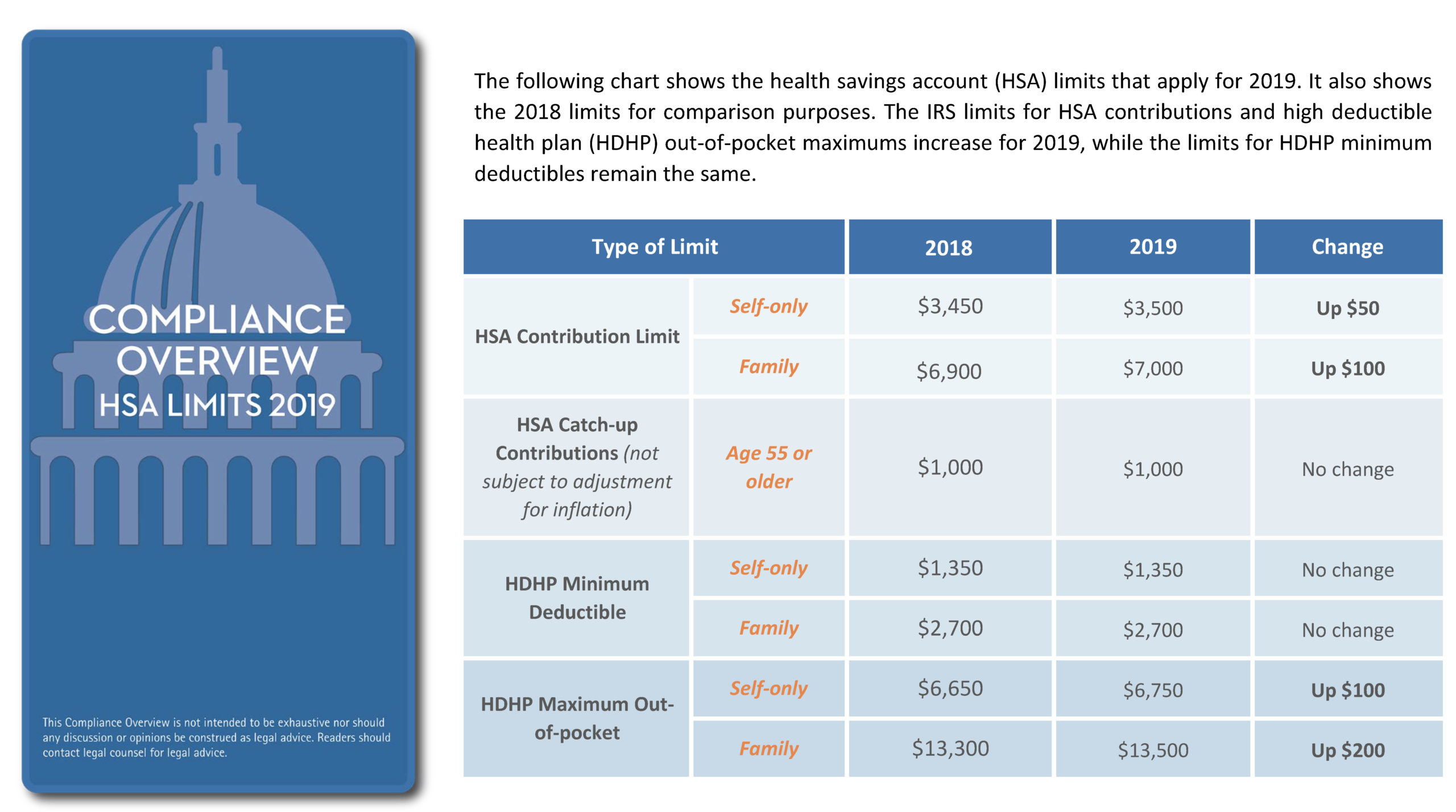

- IRS Revenue Procedure 2017-37 – HSA limits for 2018

- IRS Revenue Procedure 2018-30 – HSA limits for 2019

- Affordability Percentages Will Increase for 2019

President Trump Signs Bills Aimed to Protect Consumers from Overpaying for Prescriptions

On Wednesday, Oct. 10, 2018, President Donald Trump signed two bills into law that ban the “gag clauses” that can result in consumers overpaying for their prescriptions. Secretary of the Department of Health and Human Services, Alex Azar, said this action is the first of a series that will be seen in the coming weeks and months as the administration focuses on a key Trump campaign promise: bringing down drug prices.

What are gag clauses?

Gag clauses are included in contracts between insurers and pharmacies, and prevent the pharmacies from informing consumers that they’ll save money if they don’t use their health insurance and instead pay with cash.

How do the bills impact gag clauses?

Effectively, the bills prevent private insurers and Medicare from including such clauses in their contracts with pharmacists. The two bills—the Know the Lowest Price Act and the Patient Right to Know Drug Prices Act—promote transparency in drug pricing, which, according to the Trump administration, will result in lower drug prices.

What does this mean for you?

Being a wise health care consumer involves asking the right questions to ensure you’re getting the most affordable price for your prescribed treatments. Don’t be afraid to ask your pharmacist if you would save money by not using your health insurance next time you fill or refill a prescription.

The Tax Cuts and Jobs Act, which was signed into law last December, reduces the ACA’s individual shared responsibility (or individual mandate) penalty to zero, effective beginning in 2019.

As a result, beginning in 2019, individuals will no longer be penalized for failing to obtain acceptable health insurance coverage. Despite the repeal of the individual mandate penalty, employers and individuals must continue to comply with all other ACA provisions.