Contents

Significant Changes Proposed to Form 5500

DOL’s New Fiduciary Rule Impacts HSAs

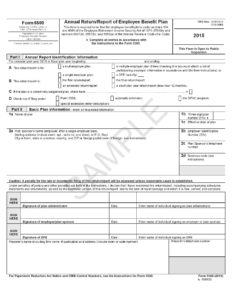

Significant Changes Proposed to Form 5500

On July 21, 2016, federal regulators published a proposed rule that aims to improve the Form 5500 annual report filed by employee benefit plans.

Under the proposal, all ERISA-covered plans that provide group health benefits, regardless of size, would be required to file a Form 5500, including the new Schedule J (Group Health Plan Information) and any other applicable schedules. The proposed changes would eliminate the current filing exemption for small group health plans, and instead, small, fully insured plans would be required to answer a limited number of questions on the Form 5500 and Schedule J.

The proposed Schedule J would report information about group health plan operations and ERISA compliance, plus compliance with certain provisions of the Affordable Care Act (ACA). Because much of the information required to be reported under the ACA’s transparency-in-coverage-reporting requirement would be included in Schedule J, the DOL is considering whether completing and filing Form 5500 and Schedule J could satisfy a group health plan’s reporting obligations.

Other proposed updates to Form 5500 include:

- Financial Information—Improved reporting on alternative investments, hard-to-value assets and investments through collective investment vehicles;

- Data Mining—Conversion of more elements of the Form 5500 into data that is organized in a structured manner to make them usable for data-mining and analytic purposes;

- Service Provider Fee Information—Updated fee and expense information for plan service providers; and

- Compliance Information—Additional reporting on plan operations, service provider relationships and financial management of plans.

If finalized, the changes would apply for plan years beginning on or after Jan. 1, 2019. Employers should monitor these proposed changes and consider how their businesses would be affected if they are finalized.

DOL’s New Fiduciary Rule Impacts HSAs

This April, the Department of Labor (DOL) published a final rule that expands on who is considered a  “fiduciary” when providing financial advice to retirement plans and their participants. This expanded definition will take effect on April 10, 2017. Other provisions related to prohibited transaction exemptions for advisors will become effective on Jan. 1, 2018.

“fiduciary” when providing financial advice to retirement plans and their participants. This expanded definition will take effect on April 10, 2017. Other provisions related to prohibited transaction exemptions for advisors will become effective on Jan. 1, 2018.

The final rule also covers health savings accounts (HSAs). The DOL determined that HSA owners are entitled to receive the same protections from conflicted investment advice as individual retirement account (IRA) owners. Individuals who provide advice on HSAs may be considered fiduciaries if their communications rise to the level of investment recommendations covered by the final rule.

The final rule clarifies that many common plan sponsor activities, such as providing investment educational information and communication with employees about distribution options, are not fiduciary investment advice.

On July 14, Democrats in Congress proposed a bill that would affect the DOL’s recent FLSA overtime exemption rule changes.

The Overtime Reform and Enhancement Act (H.R. 5813) would increase the salary threshold in the following phases:

- $35,984 by Dec. 1, 2016

- $39,814 by Dec. 1, 2017

- $43,645 by Dec. 1, 2018

- $47,476 by Dec. 1, 2019

H.R. 5813 would also eliminate the automatic salary threshold increases, which are set to occur every three years.

The bill is popular among those who view the new overtime rules as being too much, too soon. However, critics argue that the bill is detrimental to workers who have waited a long time to see an update to the salary threshold. Congress is expected to review the bill during its next session on Sept. 6, 2016.

The information provided in this alert is not, is not intended to be, and shall not be construed to be, either the provision of legal advice or an offer to provide legal services, nor does it necessarily reflect the opinions of the HealthSure, our lawyers or our clients. This is not legal advice. No client-lawyer relationship between you and our lawyers is or may be created by your use of this information. Rather, the content is intended as a general overview of the subject matter covered. HealthSure is not obligated to provide updates on the information presented herein. Those reading this alert are encouraged to seek direct counsel on legal questions.