Medicare Part D Notices Are Due Before Oct. 15, 2018

Two HSA Bills Passed by the House

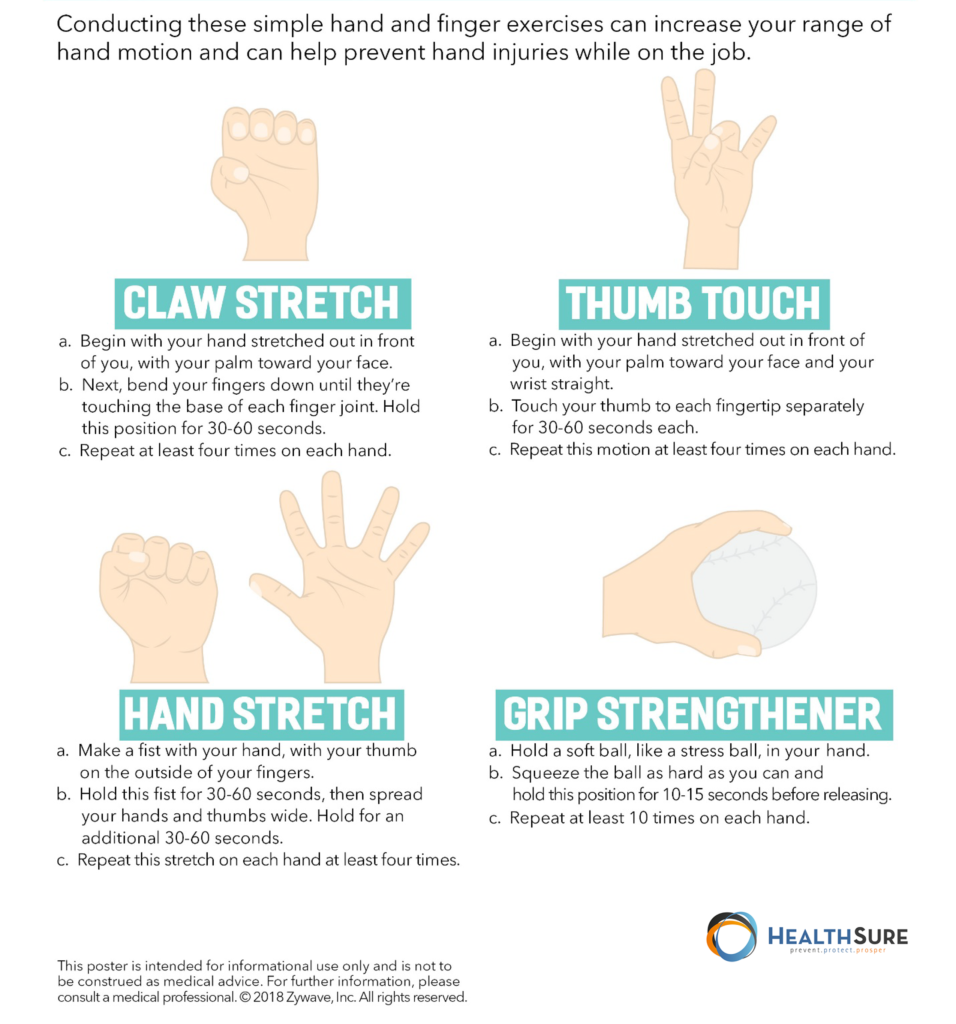

4 Exercises To Strengthen Your Hands

Did You Know: Disease management programs

Medicare Part D Notices Are Due Before Oct. 15, 2018

Overview

Each year, Medicare Part D requires group health plan sponsors to disclose to individuals who are eligible for Medicare Part D and to the Centers for Medicare and Medicaid Services (CMS) whether the health plan’s prescription drug coverage is creditable. Plan sponsors must provide the annual disclosure notice to Medicare-eligible individuals before Oct. 15, 2018—the start date of the annual enrollment period for Medicare Part D. CMS has provided model disclosure notices for employers to use.

This notice is important because Medicare beneficiaries who are not covered by creditable prescription drug coverage and do not enroll in Medicare Part D when first eligible will likely pay higher premiums if they enroll at a later date. Although there are no specific penalties associated with this notice requirement, failing to provide the notice may be detrimental to employees.

Action Steps

Employers should confirm whether their health plans’ prescription drug coverage is creditable or non-creditable and prepare to send their Medicare Part D disclosure notices before Oct. 15, 2018. To make the process easier, employers often include Medicare Part D notices in open enrollment packets they send out prior to Oct. 15.

Creditable Coverage

A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. In general, this actuarial determination measures whether the expected amount of paid claims under the group health plan’s prescription drug coverage is at least as much as the expected amount of paid claims under the Medicare Part D prescription drug benefit. For plans that have multiple benefit options (for example, PPO, HDHP and HMO), the creditable coverage test must be applied separately for each benefit option.

Model Notices

CMS has provided two model notices for employers to use:

- A Model Creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is creditable; and

- A Model Non-creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is not creditable.

These model notices are also available in Spanish on CMS’ website.

Employers are not required to use the model notices from CMS. However, if the model language is not used, a plan sponsor’s notices must include certain information, including a disclosure about whether the plan’s coverage is creditable and explanations of the meaning of creditable coverage and why creditable coverage is important.

Notice Recipients

The creditable coverage disclosure notice must be provided to Medicare Part D-eligible individuals who are covered by, or who apply for, the health plan’s prescription drug coverage. An individual is eligible for Medicare Part D if he or she:

- Is entitled to Medicare Part A or is enrolled in Medicare Part B; and

- Lives in the service area of a Medicare Part D plan.

In general, an individual becomes entitled to Medicare Part A when he or she actually has Part A coverage, and not simply when he or she is first eligible. Medicare Part D-eligible individuals may include active employees, disabled employees, COBRA participants and retirees, as well as their covered spouses and dependents.

As a practical matter, group health plan sponsors often provide the creditable coverage disclosure notices to all plan participants.

Timing of Notices

At a minimum, creditable coverage disclosure notices must be provided at the following times:

If the creditable coverage disclosure notice is provided to all plan participants annually before Oct. 15 of each year, items (1) and (2) above will be satisfied. “Prior to,” as used above, means the individual must have been provided with the notice within the past 12 months. In addition to providing the notice each year before Oct. 15, plan sponsors should consider including the notice in plan enrollment materials for new hires.

Method of Delivering Notices

Plan sponsors have flexibility in how they must provide their creditable coverage disclosure notices. The disclosure notices can be provided separately, or if certain conditions are met, they can be provided with other plan participant materials, like annual open enrollment materials. The notices can also be sent electronically in some instances.

As a general rule, a single disclosure notice may be provided to the covered Medicare beneficiary and all of his or her Medicare Part D-eligible dependents covered under the same plan. However, if it is known that any spouse or dependent who is eligible for Medicare Part D lives at a different address than where the participant materials were mailed, a separate notice must be provided to the Medicare-eligible spouse or dependent residing at a different address.

Electronic Delivery

Creditable coverage disclosure notices may be sent electronically under certain circumstances. CMS has issued guidance indicating that health plan sponsors may use the electronic disclosure standards under Department of Labor (DOL) regulations in order to send the creditable coverage disclosure notices electronically. According to CMS, these regulations allow a plan sponsor to provide a creditable coverage disclosure notice electronically to plan participants who have the ability to access electronic documents at their regular place of work, if they have access to the sponsor’s electronic information system on a daily basis as part of their work duties.

The DOL’s regulations for electronic delivery require that:

- The plan administrator uses appropriate and reasonable means to ensure that the system for furnishing documents results in actual receipt of transmitted information;

- Notice is provided to each recipient, at the time the electronic document is furnished, of the significance of the document; and

- A paper version of the document is available on request.

Also, if a plan sponsor uses electronic delivery, the sponsor must inform the plan participant that he or she is responsible for providing a copy of the electronic disclosure to their Medicare-eligible dependents covered under the group health plan.

In addition, the guidance from CMS indicates that a plan sponsor may provide a disclosure notice electronically to retirees if the Medicare-eligible individual has indicated to the sponsor that he or she has adequate access to electronic information. According to CMS, before individuals agree to receive their information via electronic means, they must be informed of their right to obtain a paper version, how to withdraw their consent and update address information, and any hardware or software requirements to access and retain the creditable coverage disclosure notice.

If the individual consents to an electronic transfer of the notice, a valid email address must be provided to the plan sponsor and the consent from the individual must be submitted electronically to the plan sponsor. According to CMS, this ensures the individual’s ability to access the information and that the system for furnishing these documents results in actual receipt. In addition to having the disclosure notice sent to the individual’s email address, the notice (except for personalized notices) must be posted on the plan sponsor’s website, if applicable, with a link on the sponsor’s homepage to the disclosure notice.

Disclosure to CMS

Plan sponsors are also required to disclose to CMS whether their prescription drug coverage is creditable. The disclosure must be made to CMS on an annual basis, or upon any change that affects whether the coverage is creditable. At a minimum, the CMS creditable coverage disclosure notice must be provided at the following times:

- Within 60 days after the beginning date of the plan year for which the entity is providing the form;

- Within 30 days after the termination of the prescription drug plan; and

- Within 30 days after any change in the creditable coverage status of the prescription drug plan.

Plan sponsors are required to provide the disclosure notice to CMS through completion of the disclosure form on the CMS Creditable Coverage Disclosure webpage. This is the sole method for compliance with the CMS disclosure requirement, unless a specific exception applies.

Two HSA Bills Passed by the House

The House of Representatives passed two bills that have the potential to transform how health savings accounts (HSAs) are used. Despite passing in the House, the two bills need to be passed by the Senate in order for them to become laws.

What do the two bills propose?

H.R. 6199 (Restoring Access to Medication and Modernizing Health Savings Accounts Act), in addition to other changes, would reverse the ACA’s prohibition on using HSAs on over-the-counter health expenses.

H.R. 6311 (Increasing Access to Lower Premium Plans and Expanding Health Savings Accounts Act), in addition to other changes, would allow certain individuals to use the ACA’s tax credit when buying low-premium Marketplace plans.

4 Exercises To Strengthen Your Hands

Disease management programs can help manage rising health care costs. In fact, a study by the RAND Corporation found that these programs result in an 87 percent savings.

Employers surveyed saw specific savings of $136 per member per month and a 30 percent decrease in hospital admissions from employees who participated in these types of programs.