Contents

President Trump Issues Executive Order on the Affordable Care Act

ACA Reporting: You Still Have to File!

New Stand-alone HRA Option Available for Eligible Small Employers

Did you know? Republican Congress taking the first steps to repeal and replace ACA

President Trump Issues Executive Order on the Affordable Care Act

by Marathas Barrow Weatherhead Lent LLP

President Trump moved swiftly after taking office on Friday, issuing an Executive Order intended to minimize the economic and regulatory burdens of the Affordable Care Act (“ACA”). The order is somewhat symbolic and has no immediate effect on employers, many of whom are in the process of complying with the ACA’s onerous reporting requirements (Forms 1094 and 1095), which are not rescinded by the order.

The order directs HHS and the heads of other departments and agencies (e.g., U.S. Department of Labor, Treasury Department) to exercise all available authority and discretion to waive, defer, grant exemptions from, or delay the implementation of any provision of the ACA that would impose a fiscal burden on any State or a cost, fee, tax, penalty, or regulatory burden on individuals, families, healthcare providers, health insurers, patients, recipients of healthcare services, purchasers of health insurance, or makers of medical devices, products, or medications. It should be noted that employers are not among those explicitly listed as requiring protection from regulatory burdens.

The order is broadly drafted and does not specify which provisions of the law should be targeted. However, to the extent that following the order would require revision of regulations issued through notice-and-comment rulemaking, the agencies will need to comply with the Administrative Procedures Act (“APA”).

Under the APA, agencies cannot rescind existing regulations until they engage in a new notice-and-comment rulemaking process (including required public comment period and delayed effective dates) and observe other procedural requirements. In practical terms, the APA makes it difficult for an incoming President to overturn final regulations implemented by a predecessor. Regulations that haven’t taken effect can be suspended while they are reviewed to determine if they conform to the new administration’s agenda, or if modification or revocation is necessary. To that end, the President’s chief of staff has instructed federal agencies to cease issuing new regulations and withdraw rules that have been sent to the Office of the Federal Register until they can be reviewed by the new agency heads.

The order is somewhat symbolic given the constraints imposed by the APA, yet is has some substantive effect. The directive gives HHS wide latitude when granting hardship exemptions from the individual mandate (it does not, however, waive the requirement for individuals to maintain minimum essential coverage). The order also signals to states that the federal government may be more receptive to granting Medicaid waivers, which afford states additional flexibility in designing and administering their programs. Another section of the order instructs the agency heads to work with states to encourage the sale of insurance across state lines, to the maximum extent permitted by law. Current law (the McCarran-Ferguson Act), protects insurance companies from interstate competition by permitting states to regulate health plans sold in their state, creating a patchwork of state insurance laws across the U.S.

From an employer perspective, employers with 50 or more full-time equivalent employees and sponsors of self-insured health plans are preparing to comply with the ACA’s reporting requirements (Forms 1094 & 1095) over the next couple of months. They may be tempted to view the order as a sign that the Internal Revenue Service will not enforce the employer mandate or ACA reporting. However, until further regulatory guidance is released, the final regulations implementing the employer mandate and its reporting requirements remain in effect and are subject to enforcement by the IRS. The IRS recently indicated in FAQ guidance that it intends to begin notifying employers of their potential liability for an employer shared responsibility payment for the 2015 calendar year “in early 2017.”

Once President Trump’s appointments to the regulatory agencies are seated we’ll likely see new regulations proposed to ease the ACA’s economic and administrative burdens, although the process will take some time. Also, now that President Trump has taken initial action on the ACA, it may ease the pressure on Congress to attempt an immediate repeal or find a replacement.

ACA Reporting: You Still Have to File!

As part of his platform during the presidential campaign, then candidate Donald Trump campaigned on the repeal and replacement of the Affordable Care Act (ACA). In keeping with his promise, President Trump signed an executive order on day one of his administration directing all agencies with authority over the ACA to use their discretion to waiver, defer, grant exceptions, or delay any provision that would impose a financial burden upon states and individuals. The order is non-specific and has no immediate effect on employers. The order can be seen as a way for the Trump Administration to have taken an initial step toward the repeal and replacement of the ACA, and may relieve the pressure on Congress to attempt to take immediate action.

Some employers may feel this action may relieve them of the necessity to file their ACA required reporting (the filing of forms 1094 and 1095 with the IRS). This is not the case. The employer requirement to perform ACA reporting for all ALE’s and small group plans that are self-funded will remain in force until such time as the requirement is officially rescinded. Failure to properly report to the IRS comes with penalties that can add up very quickly.

At HealthSure, we recommend the following to handle ACA reporting requirements:

- If your company utilizes a payroll service and offers ACA reporting as part of their package, the best option is to allow them to handle this on your company’s behalf. Please note this may come with a fee.

- If you have a payroll service that does not offer reporting services, or you do not utilize a payroll service, HealthSure has co-developed a Do-It-Yourself form generator with tools included to help our clients with their filing needs.

- If you would like a third-party option that is not your payroll service and can offer a turnkey approach to your filing requirements, we have outlets for that as well.

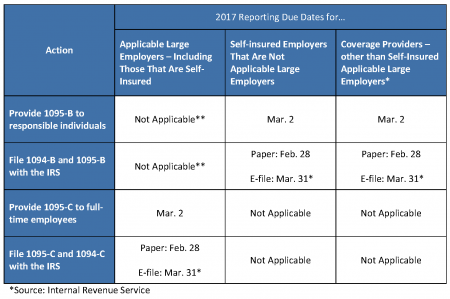

ACA Reporting requirements remain in effect. Please do not make the mistake of assuming that reporting is no longer necessary — it could cost you and your company dearly. Click here to download a Reporting Due Dates table.

New Stand-alone HRA Option Available for Eligible Small Employers

Due to the Affordable Care Act (ACA), most stand-alone health reimbursement arrangements (HRAs)—an HRA that is not offered in conjunction with a group health plan—have been prohibited since 2014. However, on Dec. 13, 2016, the 21st Century Cures Act (Act) was signed into law, which allows small employers that do not maintain group health plans to establish stand-alone HRAs, effective for plan years beginning on or after Jan. 1, 2017.

This new type of HRA is called a “qualified small employer HRA” (or QSEHRA). Like all HRAs, a QSEHRA must be funded solely by the employer. Employees cannot make their own contributions to an HRA, either directly or indirectly through salary reduction contributions. Specific requirements apply, including a maximum benefit limit and a notice requirement.

Who is eligible?

To be eligible to offer a QSEHRA, an employer must meet the following two requirements:

- The employer is not an applicable large employer (ALE) that is subject to the ACA’s employer shared responsibility rules.

- The employer does not maintain a group health plan for any of its employees.

What is the maximum benefit limit?

The maximum benefit available under the QSEHRA for any year cannot exceed $4,950 (or $10,000 for QSEHRAs that also reimburse medical expenses of the employee’s family members). These dollar amounts are subject to adjustment for inflation for years beginning after 2016. Additionally, the maximum dollar limits must be prorated for individuals who are not covered by the QSEHRA for the entire year.

What is the notice requirement?

An employer funding a QSEHRA for any year must provide a written notice to each eligible employee. This notice must be provided within 90 days of the beginning of the year. For employees who become eligible to participate in the QSEHRA during the year, the notice must be provided by the date on which the employee becomes eligible to participate.

Transition Relief Extension

The Act also extends the transition relief under IRS Notice 2015-17, so that it applies with respect to plan years beginning on or before Dec. 31, 2016.

Hours after the new Congress convened on Jan. 3, 2017, chairman of the Senate Budget Committee, Sen. Mike Enzi, R-WY, introduced a resolution that serves as Republican lawmakers’ first steps to repealing and replacing the ACA.

To overcome a Democratic filibuster in the Senate, Republican lawmakers will have to use a special legislative maneuver, called a budget resolution, to repeal parts of the ACA that have budgetary or tax implications.

Enzi’s resolution calls on the Senate to draft and submit a bill to the Budget Committee by Jan. 27, 2017.

The information provided in this alert is not, is not intended to be, and shall not be construed to be, either the provision of legal advice or an offer to provide legal services, nor does it necessarily reflect the opinions of the agency, our lawyers or our clients. This is not legal advice. No client-lawyer relationship between you and our lawyers is or may be created by your use of this information. Rather, the content is intended as a general overview of the subject matter covered. HealthSure and Marathas Barrow Weatherhead Lent LLP are not obligated to provide updates on the information presented herein. Those reading this alert are encouraged to seek direct counsel on legal questions.