IRS Extends Deadline for Furnishing Form 1095-C, Extends Good-Faith Transition Relief

Rule on Health Care Transparency to Affect Some Employer Plans

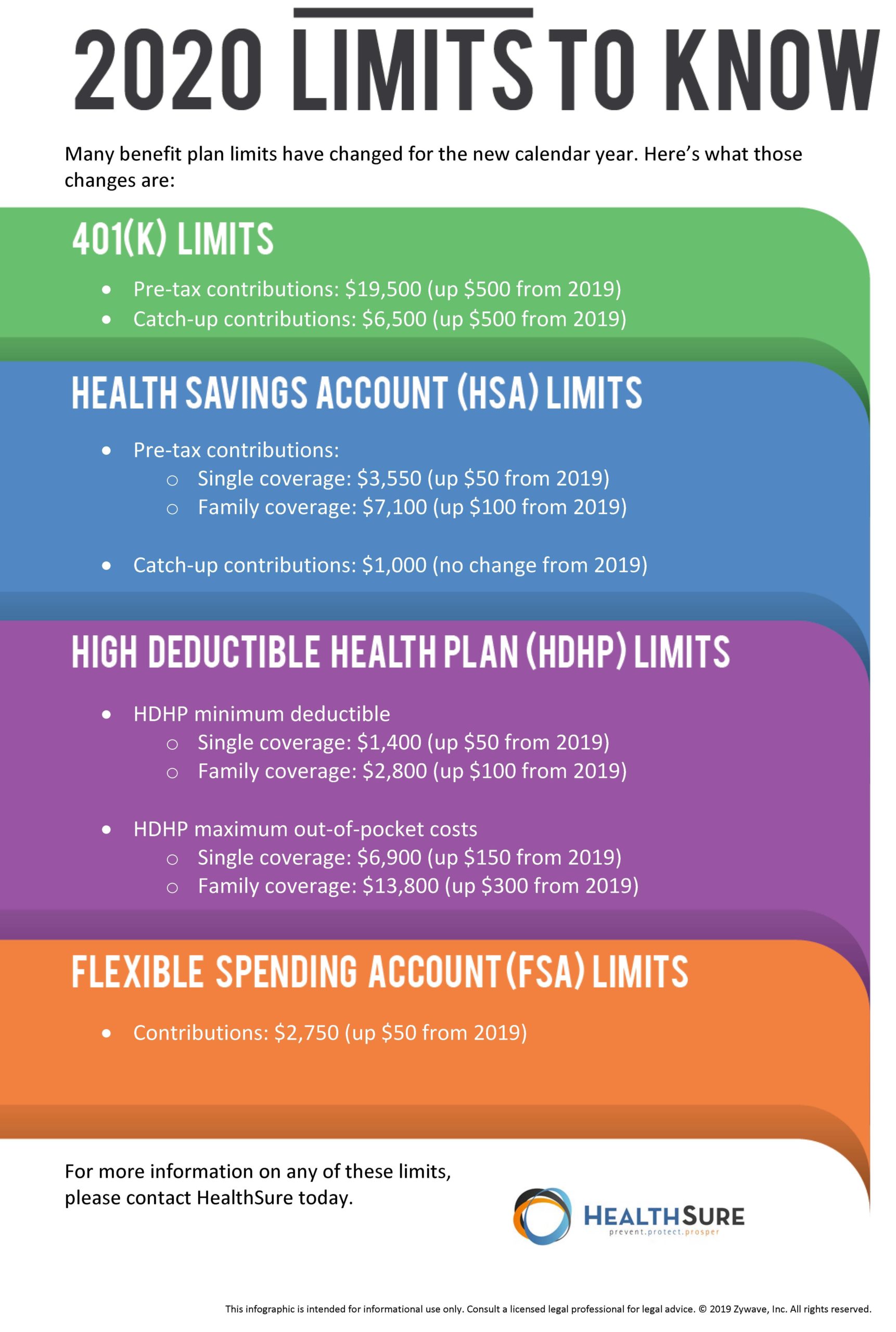

FSA Contribution and Other Benefits Limits Rise for 2020

DOL Proposes New Method for Electronic Delivery of Retirement Plan Disclosures

IRS Extends Deadline for Furnishing Form 1095-C, Extends Good-Faith Transition Relief

The Internal Revenue Service (IRS) has released Notice 2019-63, which extends the deadline for furnishing 2019 Forms 1095-B and 1095-C to individuals from January 31, 2020 to March 2, 2020. The Notice also provides penalty relief for good-faith reporting errors and suspends the requirement to issue Form 1095-B to individuals, under certain conditions.

The due date for filing the forms with the IRS was not extended and remains February 28, 2020 (March 31, 2020 if filed electronically).

The draft instructions to Forms 1094-C and 1095-C allow employers to request a 30-day extension to furnish statements to individuals by sending a letter to the IRS with certain information, including the reason for delay. However, because the Notice’s extension of time to furnish the forms is as generous as the 30-day extension contained in the instructions, the IRS will not formally respond to requests for an extension of time to furnish 2019 Forms 1095-B or 1095-C to individuals.

Employers may still obtain an automatic 30-day extension for filing with the IRS by filing Form 8809 on or before the forms’ due date. An additional 30-day extension is available under certain hardship conditions. The Notice encourages employers who cannot meet the extended due dates to furnish and file as soon as possible and advises that the IRS will take such furnishing and filing into consideration when determining whether to abate penalties for reasonable cause.

Relief from Furnishing Form 1095-B to Individuals

Due to the individual mandate penalty being reduced to zero starting in 2019, an individual does not need the information on Form 1095-B in order to complete his or her federal tax return. Therefore, the IRS is granting penalty relief for employers who fail to furnish a Form 1095-B to individuals, provided that the reporting entity:

- Posts a notice prominently on its website stating that individuals may receive a copy of their 2019 1095-B upon request, accompanied by an email address, phone number and a physical address the request can be sent; and

- Furnishes an individual with a Form 1095-B within 30 days of a request.

Note that Applicable Large Employers (ALEs) are still required to furnish Form 1095-C to their full-time employees. They must also complete Part III if the employee is enrolled in self-insured coverage. The relief from furnishing Form 1095-B does not extend to IRS reporting. Forms 1095-B must still be submitted to the IRS, as applicable.

Extension of Good-Faith Relief

As with calendar year 2015 – 2018 reporting, the IRS will not impose penalties on employers that can show that they made good-faith efforts to comply with the requirements for calendar year 2019. In determining good faith, the IRS will consider whether employers have made reasonable attempts to comply with the requirements (e.g., gathering and transmitting the necessary data to an agent or testing its ability to transmit information) and the steps that have been taken to prepare for next year’s reporting.

Note that the relief applies only to furnishing and filing incorrect or incomplete information, and not to a failure to timely furnish or file. However, if an employer is late filing a return, it may be possible to get penalty abatement for failures that are due to reasonable cause and not willful neglect. In general, to establish reasonable cause the employer must demonstrate that it acted in a responsible manner and that the failure was due to significant mitigating factors or events beyond its control. The IRS has been enforcing late filing penalties via Letter 972CG, which may include penalties based on failed to file electronically (when required), or failure to file with correct TIN information.

As in past years, individuals can file their personal income tax return without having to attach the relevant Form 1095. Taxpayers should keep these forms in their personal records, even though the federal individual mandate penalty is not applicable for the 2019 filing year.

Rule on Health Care Transparency to Affect Some Employer Plans

OVERVIEW

On Nov. 15, 2019, the Departments of Labor (DOL), Health and Human Services (HHS) and the Treasury (Departments) issued a proposed rule regarding transparency in coverage that would impose new transparency requirements on group health plans and health insurers in the individual and group markets. Specifically, the proposed rule would require plans and issuers to disclose:

- Cost-sharing estimates to participants, beneficiaries and enrollees upon request; and

- In-network provider-negotiated rates and historical out-of-network allowed amounts on their website.

The proposals would only apply to non-grandfathered coverage, and would also apply to self-insured group health plan sponsors.

ACTION STEPS

This proposed rule was issued in response to an executive order issued on June 24, 2019, aimed at improving price and quality transparency in health care. The order is intended to increase availability of health care price and quality information and protect patients from surprise medical bills.

The Executive Order

The executive order was intended to enhance the ability of patients to choose the health care that is best for them by increasing access to information regarding price and quality of health care goods and services. Specifically, the order was aimed at:

- Eliminating unnecessary barriers to price and quality transparency;

- Increasing the availability of meaningful price and quality information for patients;

- Enhancing patients’ control over their own health care resources, including through tax-preferred medical accounts; and

Protecting patients from surprise medical bills.

Among other things, the executive order directed the Departments to issue a proposed rule to require health care providers, health insurance issuers and self-insured group health plans to provide information about expected out-of-pocket costs for items or services to patients before they receive care.

Health Care Transparency Proposed Rule

The proposed rule would impose new transparency requirements on group health plans and health insurers in the individual and group markets—including self-insured plans. Specifically, the proposed rule includes the following two approaches intended to make health care price information accessible to consumers and other stakeholders, allowing for easy comparison-shopping.

The proposed rule would also allow issuers that share savings with consumers that result from consumers shopping for lower-cost, higher-value services, to take credit for those “shared savings” payments in their medical loss ratio (MLR) calculations. This is intended to ensure that issuers would not be required to pay MLR rebates based on a plan design that would provide a benefit to consumers that is not currently captured in any existing MLR revenue or expense category.

The proposed rule would also allow issuers that share savings with consumers that result from consumers shopping for lower-cost, higher-value services, to take credit for those “shared savings” payments in their medical loss ratio (MLR) calculations. This is intended to ensure that issuers would not be required to pay MLR rebates based on a plan design that would provide a benefit to consumers that is not currently captured in any existing MLR revenue or expense category.

This proposed rule also solicits comments on:

- Whether group health plans and health insurance issuers should also be required to disclose cost-sharing information through other means, such as a standards-based application programming interface (API); and

- How health care quality information can be incorporated into the price transparency proposals included in the proposed rule.

Comments must be submitted by 60 days from the release of the proposed rule. The provisions included in the proposed rule are proposed to apply for plan years (or, in the individual market, policy years) beginning on or after one year after the finalization of the rule. However, the MLR provision would be applicable beginning with the 2020 MLR reporting year.

FSA Contribution and Other Benefits Limits Rise for 2020

The IRS announced an increase to flexible spending account (FSA) contribution limits for the 2020 plan year.

Individuals can contribute $2,750 in 2020, up $50 from the previous year.

Since this announcement came so late in the year, some employers may not use the updated figures in their benefits limits—as doing so would require an addendum.

In fact, some employers have been known to use limits from the previous year because they cannot wait until this far into the enrollment season to release benefits materials.

With that in mind, it wouldn’t be surprising if employers use the 2019 limits for their FSA plans in 2020.

In addition to the FSA contribution limits, the IRS announced increases for transportation benefits and adoption services.

Qualified transportation benefit limits (for parking or transit passes) increased to $270 for 2020.

Maximum employer subsidies for qualified adoption expenses rose to $14,300, up $220. Other adoption-related limits increased as well.

For more information on these or other benefits plan limits, please speak with HealthSure Insurance Services, Inc. today.

DOL Proposes New Method for Electronic Delivery of Retirement Plan Disclosures

The U.S. Department of Labor (DOL) published a proposed rule in October that would allow plan administrators to make retirement plan disclosures available on a website.

If the proposal is adopted, plan administrators may continue to use the existing safe harbor for electronic delivery, or to furnish paper documents by hand-delivery or mail.

The proposal would provide a new, optional method where plan administrators who satisfy specified conditions may furnish documents electronically, unless participants affirmatively opt out.

Speak with us to learn more about this proposed rule and how it may affect your organization.