Hardship Exemption Rules Eased for 2018 Individual Mandate

IRS Issues Letters to Non-Compliant Employers

PCORI Fee Amount Adjusted for 2018

Here’s What to Know About 1095-C

Did you know? Federal Overtime Rules

Hardship Exemption Rules Eased for 2018 Individual Mandate

The Centers for Medicare & Medicaid Services (CMS) has provided guidance making it easier to claim a hardship exemption from the individual mandate under the Affordable Care Act (ACA) for 2018.

Individuals may claim a hardship exemption on their 2018 federal income tax return without:

- Obtaining a hardship exemption certification from the Exchange

- Providing any explanation or documentation of the hardship

In past years, most individuals had to apply for the exemption and receive a certification from an Exchange to qualify.

Only certain individuals were able to claim a hardship exemption without obtaining a certification in prior years:

- Individuals with income below the tax filing threshold

- Family members whose combined cost of self-only coverage is considered unaffordable

- Individuals who are eligible for services through an Indian health care provider

- Individuals who are ineligible for Medicaid based on a state’s decision not to expand Medicaid

Under the new guidance, any individual can claim a hardship exemption without obtaining a certification. This change applies to 2018 only.

However, for all other eligible years, individuals can still apply for hardship exemptions through the Exchange, and CMS will continue to process those as normal.

At this time, there is no change to the Employer Mandate. No exemptions are required after 2018 because the individual mandate has been effectively repealed beginning in 2019.

IRS Issues Letters to Non-Compliant Employers

The IRS has been sending Letter 5699 to employers that have not complied with their ACA reporting requirements for 2015.

Letter 5699 requests missing information from applicable large employers (ALEs) that were required to report under Section 6056, but failed to file Forms 1094-C and 1095-C with the IRS. The IRS identifies potentially non-compliant ALEs based on their Form W-2 total employee count reported for 2015.

Employers who receive a Letter 5699 should respond within the appropriate time frame and provide all appropriate information requested by the IRS, including any forms that are due.

Penalties may apply for any failures to file with the IRS by required deadlines. The IRS will use information provided in response to Letter 5699 to identify non-compliant ALEs and assess any penalties that may be owed.

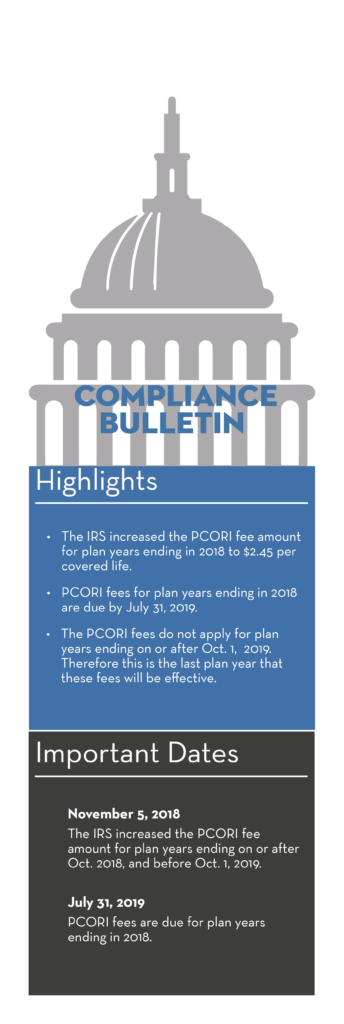

PCORI Fee Amount Adjusted for 2018

OVERVIEW

The Affordable Care Act (ACA) imposes a fee on health insurance issuers and self-insured plan sponsors in order to fund comparative effectiveness research. These fees are widely known as Patient-Centered Outcomes Research Institute (PCORI) fees.

On Nov. 5, 2018, the Internal Revenue Service (IRS) published Notice 2018-85, which increased the PCORI fee amount for plan years ending on or after Oct. 1, 2018, and before Oct. 1, 2019 (that is, 2018 for calendar year plans), to $2.45 multiplied by the average number of lives covered under the plan.

The PCORI fees do not apply for plan years ending on or after Oct. 1, 2019. Therefore, for calendar year plans, the 2018 plan year is the last plan year that these fees will be effective.

ACTION STEPS

PCORI fees are reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return). These fees are due each year by July 31 of the year following the last day of the plan year. This means that, for plan years ending in 2018, the PCORI fees are due by July 31, 2019. Covered employers should have reported and paid PCORI fees for 2017 by July 31, 2018.

Overview of PCORI Fees

The PCORI fees apply for plan years ending on or after Oct. 1, 2012, but do not apply for plan years ending on or after Oct. 1, 2019. For calendar year plans, the fees will be effective for the 2012 through 2018 plan years. Therefore, the 2018 plan year is the last plan year that these fees will be effective, for calendar year plans

Issuers and plan sponsors must pay PCORI fees annually on IRS Form 720 by July 31 of each year. The fee will generally cover plan years that end during the preceding calendar year. For the 2018 plan year, PCORI fees are due by July 31, 2019.

PCORI Fee Amounts

The PCORI fees are calculated by multiplying an applicable rate for each tax year by the average number of lives covered under the plan. The applicable rate for each tax year is as follows:

- $1 for plan years ending before Oct. 1, 2013 (that is, 2012 for calendar year plans); and

- $2 for plan years ending on or after Oct. 1, 2013, and before Oct. 1, 2014.

For plan years ending on or after Oct. 1, 2014, the IRS published the adjusted PCORI fee amount each year, which is calculated based on the percentage increase in the projected per capita amount of the national health expenditures published by the Department of Health and Human Services (HHS) each year.

- On Sept. 18, 2014, IRS Notice 2014-56 adjusted the PCORI fee amount to $2.08 times the average number of covered lives for plan years ending on or after Oct. 1, 2014, and before Oct. 1, 2015.

- On Oct. 9, 2015, IRS Notice 2015-60 adjusted the PCORI fee amount to $2.17 times the average number of covered lives for plan years ending on or after Oct. 1, 2015, and before Oct. 1, 2016.

- On Nov. 4, 2016, IRS Notice 2016-64 adjusted the PCORI fee amount to $2.26 times the average number of covered lives for plan years ending on or after Oct. 1, 2016, and before Oct. 1, 2017.

- On Oct. 9, 2017, IRS Notice 2017-61 adjusted the PCORI fee amount to $2.39 times the average number of covered lives for plan years ending on or after Oct. 1, 2017, and before Oct. 1, 2018.

Under Notice 2018-85, the adjusted PCORI fee amount for plan years ending on or after Oct. 1. 2018, and before Oct. 1, 2019, is $2.45 multiplied by the average number of lives covered under the plan. This amount was calculated based on the percentage increase in the projected per capita amount of the national health expenditures, published by HHS on Feb. 14, 2018 (Table 3).

Here’s What to Know About 1095-C

Another overhaul of the federal overtime rules may be looming on the horizon.

The Department of Labor has hinted that it is looking to reveal its proposed changes to overtime eligibility in the first quarter of 2019.

Officials haven’t explained how this latest revision will differ from the stalled attempt in 2016. Experts suspect the threshold will be lower than the original $47,500 proposal.

Stay tuned for updates in early 2019.