Contents

Three Welcoming Waypoints on the Rural Healthcare Journey

Make Your Resolutions Mean Something

Here We Grow Again! HealthSure Welcomes New Team Members

Three Welcoming Waypoints on the Rural Healthcare Journey

By Brant Couch, CIC, CPA

How far will you go?

How far will you go to protect and improve the health of your hospital?

Trying to maintain status quo is becoming increasingly perilous for rural and community hospital leaders. Relentless attacks from multiple aggressors have tested the endurance and resolve of even the staunchest among us. What once could be counted on for survival has been eroded if not completely destroyed.

Perhaps the real question is, “How far can you go?”

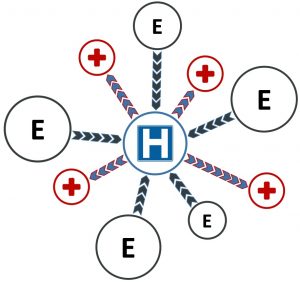

For a growing number of hospital leaders, the answer lies in the experience of others; rural and community hospital leaders who, in seeing status quo cannot endure, overcome inertia, embrace change, and set off on a journey to a better future. As with most journeys, the unexpected is happening. Along the way, they’re meeting others who share the same abiding passion for rural healthcare. They are sharing what they’ve learned and finding new ways to collaborate. Together, they are discovering new ways to turn risk into an asset. And, for those who wish to follow, they have established three distinct way-points to inspire, guide and support you on your journey.

Staying Home with Status Quo

Traditionally, the stay-at-home employer maintains a fully-insured employee benefits program and thinks about employee benefits for two months or less every year.

For the other 10 months, nothing much of consequence happens. But, when renewal time comes along and their broker presents a premium increase from the insurance company, they’re jolted into action. The scramble to put together a less costly plan begins and they look for ways to pass more cost onto employees, or ask other brokers to bid hoping for a cheaper alternative. They then somehow survive open enrollment and, after the dust settles, settle in for another ten months of living with a form of status quo that is just a little worse than it was the year before.

It’s not a journey; it’s more like walking around your backyard and finding your fence fallen down and weeds invading your garden. You may groan about being forced to do basic maintenance to keep your yard looking respectable but, despite your efforts, it looks worse for wear with every passing year.

The stay-at-home employer is certainly not exploring what their benefit program can do for the health of their hospital and employees. They are simply keeping it on life support.

Way-point #1: Leaving Home in the Right Direction

After years of squeezing every nickel of savings out of a traditional, fully-insured program, many rural and community hospital leaders have asked, “Where can I go from here?”

The most successful have chosen to head towards a distinct way-point and acquired a strategic compass for maintaining their heading as they navigate around and through the obstacles they encounter.

The most commonly chosen destination, Way-point #1, is replacing a traditional, fully-insured program with an appropriate alternative funding strategy. The strategic compass they use to maintain their heading, come what may, is the belief that risk can be turned into an asset.

Just in case you don’t think risk can be turned into an asset, ask yourself how it is that big insurance makes record profits year after year?

Big insurance is able to reap these enormous profits* for two reasons. First, in a case of classic misdirection, they have created a risk avoidance culture. They tell us, “Risk is bad, it’s dangerous, it must be avoided at all costs, let us take it off your hands.”

The second reason is big insurance* knows risk is an extremely valuable asset when it is well managed.

They do not profit because they are better than their clients at managing risk. In fact, quite the opposite is true; they profit because by paying big insurance to take away your risk, you are paying them to take away an asset. This is where your big opportunity lies. Because you can manage your risk better than anyone – you can certainly do a better job than big insurance – you have the ability to turn it into an asset.

But, in order to effectively manage risk, you need information. You need to know where you are vulnerable, what it’s costing you, and most importantly, how to reduce or eliminate each area of vulnerability. When you are fully insured, the information you need to turn risk into an asset is profitably controlled by big insurance. The only way to gain control of the information you need is to claim ownership of your risk by implementing a self-funded employee benefits program.

Waypoint #1: Great Amenities for All

- Plan design cost savings: When you design and manage your plan based on what you need it to do for your employees and hospital instead of the needs and policies of big insurance, you have the opportunity to save money.

- More control and flexibility: You can work directly with your risk management advisor and TPA to create a plan that exactly fits your needs and allows you to adjust terms and solutions as your needs change.

- Hello cash flow: Instead of pre-paying premiums to big insurance, self-funding means you only pay claims when services are delivered. This can result in more cash flow control and bottom line savings.

- Bye-bye premium taxes: States charge a premium tax of between 2 and 3 percent. With a self-funded program, your premiums are vastly reduced even though you are still paying for some stop-loss insurance – see Waypoint #2.

- Data-driven employee communications and plan design: When you own your risk, you own your data. When you know what has happened and is happening, you can better predict and greatly influence what will happen.

To make the most of Waypoint #1: Self-funding, here are a few tips from experienced travelers:

- Take care of your own: Build incentives into your plan encouraging employees to use your hospital (and its clinics and pharmacy) whenever possible.

- Try reverse direct contracting: You may be all too familiar with and perhaps wary of employers who wish to save money by directly contracting with your hospital for their employee care. (There is a way to benefit from this strategy – see Waypoint #3). You too can get into this game by contracting with other providers for highly specialized and costly employee health treatments not performed in-house.

- Bottom-up pricing strategies: As a healthcare provider, you know that what is billed does not always reflect the true cost of the service provided. Self-funding gives you the opportunity to use your knowledge to reduce the cost of claims paid for expensive treatments not available in house. Traditional, fully insured plans are at the mercy of what big insurance deems fair and it is not uncommon for providers to bill 350 percent of the “bottom” Medicare price. You can do much better!

- Pharmacy transparency: If you do not have an in-house pharmacy, consider setting one up… the potential savings are substantial. Whether you have one or not, be sure your employees know the difference in cost between the prescription options available to them. And, make sure they know their choices have a direct impact on the cost of their health plan.

Waypoint #2: Safety and Strength in Numbers

Embarking on a journey almost always means meeting new people. And, if they happen to be like-minded and heading in the same direction, you will probably benefit from traveling together.

This is what’s happening with increasing frequency as hospital leaders journey towards better rural healthcare.

Once they have arrived at Waypoint #1 and are self-funding their plan, they need to acquire insurance for those unexpected, infrequent but extremely expensive claims. Traditionally, they would buy this coverage from a stop-loss insurance provider. While the premiums paid are a fraction of those paid for a traditional, fully-insured plan, the relationship with the carrier is much the same.

An alternative more and more hospital leaders (and employers in general) are embracing is to become part owners of a risk and insurance captive. Captive is just a fancy word for company used to distinguish between insurance companies and a collaborative arrangement between similar business entities.

Here’s an example: By facilitating collaboration between a growing number of hospital leaders, HealthSure has been making their journey easier and more rewarding through a national captive called the Community Hospital Insurance Coalition or CHIC for short.

The outstanding aspect of CHIC is that it is owned by participating hospitals, not by a profit-driven insurance company. And, unlike other captives, CHIC goes well beyond providing financial protection from unexpected, infrequent but extremely expensive claims.

By actively sharing strategic advice and providing leadership support for each other, CHIC members are securing their success and accelerating their progress in many ways. Here are just a few:

- Instead of reacting to big insurance demands, CHIC members are making employee health plan design and management decisions that much better reflect and support their hospital’s business strategy.

- Wisdom sharing driven by pooled data intelligence is providing deep insight into better claims mitigation and avoidance, claims management, and cost-control strategies.

- Member employees more clearly understand they have skin in the game and are becoming better stewards of their healthcare dollars.

- Improved employee healthcare utilization, better cost control and collective buying power are leading to annual cash reimbursements.

- Regional collaboration efforts are speeding CHIC member’s progress towards Waypoint #3: The Custom Network Frontier

Waypoint #3: The Custom Network Frontier

How far can you go?

Out there, on the near horizon, is a big idea drawing the attention of rural hospital leaders who have reached Waypoint #2. It is made possible by taking collaboration to a higher level. And, conceptually at least, it is a logical, two-part strategy.

One part is to collaborate to build a custom network of regional healthcare providers around your hospital. This can include other rural hospitals plus specialty clinics, med tech and large, urban hospitals. The goal is to put your hospital (and the other community hospitals) in the middle of this network and serve as the primary care deliverer.

Ideally, for every treatment and service you do not provide, you will have an alternative provider in your custom network.

The other part of this strategy is to offer major employers in your region preferred access to your custom network.

Admittedly, building a custom network poses a number of significant challenges. Not the least of which is getting a group of rural hospital leaders to the table in an effort to stop competing and start collaborating. As well, negotiating with every tertiary provider and a big urban hospital to get them to agree to provide services in a preferred manner is also a challenge.

It is a chicken and egg challenge because it helps to have negotiating power with both the employers and the tertiary healthcare providers. The more strategic partners you have in your provider network, the easier it becomes to attract employers. And, the more employers who build your network into their employee health plans, the better able you are to attract tertiary healthcare providers.

However, progress towards Way-point #3: The Custom Network Frontier is already being made by those rural hospital leaders who have implemented the “reverse direct contracting” with larger, local employers.

Since presenting this idea to several groups of rural hospital and other healthcare leaders in the last months of 2019, I have been collaborating with several hospital leaders to further develop the custom network strategy. It will be exciting to see how far we can take it.

How far can you go?

I believe one of the most disturbing of all journeys is one where you unintentionally end up where you started; no better off, but definitely road-weary and disillusioned. And, of course, if we look back at all the difficulties we have already faced in our long journey to better rural healthcare, we might never have started out at all. But, despite everything we’ve faced, I have seen rural hospital leaders time and time again discover, often to their great surprise, that they are able to do things they were a first afraid to try and thought impossible to achieve.

Finally, always remember there are established way-points ahead. So, no matter how far you go, you can take comfort in knowing you will never go it alone.

If you would like to discuss any of the strategies discussed in this article, contact us.

*(In 2018 United Health Group topped the big five with $12.9 billion in profit while Humana brought up the rear in fifth with nearly $1.7 billion.)

Make Your Resolutions Mean Something

HealthSure Welcomes New Team Members

The Employee Benefits team is excited to welcome two new members.

Jessica Harriger, Account Executive, brings over 10 years of experience in insurance and employee benefits. She has a broad understanding of medical and ancillary products. Jessica prides herself on building and maintaining client relationships while providing superb customer service. Her dedication and tenacity are invaluable to HealthSure clients.

Stacey Kleinsasser, Assistant Account Manager, brings several years of experience in customer service. Her attention to detail and problem solving skills will be a vital resource to our clients. She brings a strong commitment to bring excellent customer service to HealthSure’s clients.

The P and C Team is excited to welcome two new team members.

Pollyanna Lengel, Account Executive, brings 30 years of experience in the Property and Casualty insurance industry. She has a keen understanding of Captive Insurance Companies including the formation of such programs. Pollyanna proven client service and leadership skills will be essential to the continued realization of HealthSure’s commitment to deliver exceptional value and client service. Her proven client service and leadership skills will be essential to the continued realization of HealthSure’s commitment to deliver exceptional value and client service.

Cindy Corbitt, Account Manager, brings more than 20 years of experience in Personal and Commercial lines insurance and customer service. She has earned multiple Customer service awards, Quality Awards, Honors and Founders Awards from previous employers. Cindy’s excellent customer service will be an asset to her clients.

HealthSure is excited to welcome Shelby Sumerlin as our new Office Coordinator and Executive Assistant. She graduated from Texas State University with a degree in Fashion Merchandising and Business Administration and has over ten years of administrative and office management experience behind her. She uses her organizational skills to ensure smooth operations in a busy work environment and provides top notch support to our executive team.

Small but important print

This communication is designed to provide a summary of significant developments to our clients. Information presented is based on known provisions. Additional facts and information or future developments may affect the subjects addressed. It is intended to be informational and does not constitute legal advice regarding any specific situation. Plan sponsors should consult and rely on their attorneys for legal advice.

©2020 HealthSure. All Rights Reserved.