Compliance Bulletin: Medicare Part D Notices Are Due by Oct. 14, 2017

Court Requires EEOC to Substantiate 30% Limit on Wellness Program Incentives

Health and Wellness Newsletter

Senate Rejects ACA Repeal Efforts

Updated Form I-9 Required Beginning Sept. 18

Did you know? The Department of Treasury Shuts Down myRA

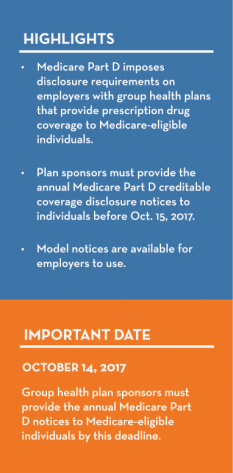

Medicare Part D Notices Are Due by Oct. 14, 2017

OVERVIEW

Each year, Medicare Part D requires group health plan sponsors to disclose to individuals who are eligible for Medicare Part D and to the Centers for Medicare and Medicaid Services (CMS) whether the health plan’s prescription drug coverage is creditable. Plan sponsors must provide the annual disclosure notice to Medicare-eligible individuals before Oct. 15, 2017—the start date of the annual enrollment period for Medicare Part D. CMS has provided model disclosure notices for employers to use.

This notice is important because Medicare beneficiaries who are not covered by creditable prescription drug coverage and who choose not to enroll in Medicare Part D when first eligible will likely pay higher premiums if they enroll at a later date. Thus, although there are no specific penalties associated with this notice requirement, failing to provide the notice may trigger adverse employee relations issues.

ACTION STEPS

Employers should confirm whether their health plans’ prescription drug coverage is creditable or non-creditable and prepare to send their Medicare Part D disclosure notices by Oct. 14, 2017. To make the process easier, employers who send out open enrollment packets prior to Oct. 15 often include the Medicare Part D notices in these packets.

Creditable Coverage

A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. In general, this actuarial determination measures whether the expected amount of paid claims under the group health plan’s prescription drug coverage is at least as much as the expected amount of paid claims under the Medicare Part D prescription drug benefit. For plans that have multiple benefit options (for example, PPO, HDHP and HMO), the creditable coverage test must be applied separately for each benefit option.

Model Notices

CMS has provided two model notices for employers to use:

- A Model Creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is creditable; and

- A Model Non-creditable Coverage Disclosure Notice for when the health plan’s prescription drug coverage is not creditable.

These model notices are also available in Spanish on CMS’ website.

Employers are not required to use the model notices from CMS. However, if the model language is not used, a plan sponsor’s notices must include certain information, including a disclosure about whether the plan’s coverage is creditable and explanations of the meaning of creditable coverage and why creditable coverage is important.

Notice Recipients

The creditable coverage disclosure notice must be provided to Medicare Part D-eligible individuals who are covered by, or who apply for, the health plan’s prescription drug coverage. An individual is eligible for Medicare Part D if he or she:

- Is entitled to Medicare Part A or is enrolled in Medicare Part B; and

- Lives in the service area of a Medicare Part D plan.

In general, an individual becomes entitled to Medicare Part A when he or she actually has Part A coverage, and not simply when he or she is first eligible. Medicare Part D-eligible individuals may include active employees, disabled employees, COBRA participants and retirees, as well as their covered spouses and dependents.

As a practical matter, group health plan sponsors often provide the creditable coverage disclosure notices to all plan participants.

Timing of Notices

At a minimum, creditable coverage disclosure notices must be provided at the following times:

If the creditable coverage disclosure notice is provided to all plan participants annually before Oct. 15 of each year, items (1) and (2) above will be satisfied. “Prior to,” as used above, means the individual must have been provided with the notice within the past 12 months. In addition to providing the notice each year before Oct. 15, plan sponsors should consider including the notice in plan enrollment materials provided to new hires.

Method of Delivering Notices

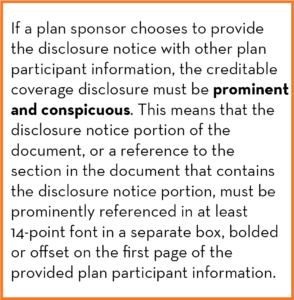

Plan sponsors have flexibility in how they must provide their creditable coverage disclosure notices. The disclosure notices can be provided separately, or if certain conditions are met, they can be provided with other plan participant materials, like annual open enrollment materials. The notices can also be sent electronically in some instances.

As a general rule, a single disclosure notice may be provided to the covered Medicare beneficiary and all of his or her Medicare Part D-eligible dependents covered under the same plan. However, if it is known that any spouse or dependent who is eligible for Medicare Part D lives at a different address than where the participant materials were mailed, a separate notice must be provided to the Medicare-eligible spouse or dependent residing at a different address.

Electronic Delivery

Creditable coverage disclosure notices may be sent electronically under certain circumstances. CMS has issued guidance indicating that health plan sponsors may use the electronic disclosure standards under Department of Labor (DOL) regulations in order to send the creditable coverage disclosure notices electronically. According to CMS, these regulations allow a plan sponsor to provide a creditable coverage disclosure notice electronically to plan participants who have the ability to access electronic documents at their regular place of work, if they have access to the sponsor’s electronic information system on a daily basis as part of their work duties.

The DOL’s regulations for electronic delivery require that:

- The plan administrator use appropriate and reasonable means to ensure that the system for furnishing documents results in actual receipt of transmitted information;

- Notice is provided to each recipient, at the time the electronic document is furnished, of the significance of the document; and

- A paper version of the document is available on request.

Also, if a plan sponsor uses electronic delivery, the sponsor must inform the plan participant that the participant is responsible for providing a copy of the electronic disclosure to their Medicare-eligible dependents covered under the group health plan.

In addition, the guidance from CMS indicates that a plan sponsor may provide a disclosure notice electronically to retirees if the Medicare-eligible individual has indicated to the sponsor that he or she has adequate access to electronic information. According to CMS, before individuals agree to receive their information via electronic means, they must be informed of their right to obtain a paper version, how to withdraw their consent and update address information, and any hardware or software requirements to access and retain the creditable coverage disclosure notice.

If the individual consents to an electronic transfer of the notice, a valid email address must be provided to the plan sponsor and the consent from the individual must be submitted electronically to the plan sponsor. According to CMS, this ensures the individual’s ability to access the information as well as ensures that the system for furnishing these documents results in actual receipt. In addition to having the disclosure notice sent to the individual’s email address, the notice (except for personalized notices) must be posted on the plan sponsor’s website, if applicable, with a link on the sponsor’s home page to the disclosure notice.

Disclosure to CMS

Plan sponsors are also required to disclose to CMS whether their prescription drug coverage is creditable. The disclosure must be made to CMS on an annual basis, or upon any change that affects whether the coverage is creditable. At a minimum, the CMS creditable coverage disclosure notice must be provided at the following times:

- Within 60 days after the beginning date of the plan year for which the entity is providing the form;

- Within 30 days after the termination of the prescription drug plan; and

- Within 30 days after any change in the creditable coverage status of the prescription drug plan.

Plan sponsors are required to provide the disclosure notice to CMS through completion of the disclosure form on the CMS Creditable Coverage Disclosure webpage. This is the sole method for compliance with the CMS disclosure requirement, unless a specific exception applies.

Court Requires EEOC to Substantiate 30% Limit on Wellness Program Incentives

by Marathas Barrow Weatherhead Lent LLP

On August 22, 2017, a federal court in the District of Columbia ordered the Equal Employment Opportunity Commission (EEOC) to reconsider the limits it placed on wellness program incentives under final regulations the agency issued last year under the Americans with Disabilities Act (ADA) and the Genetic Information Nondiscrimination Act (GINA). As part of the final regulations, the EEOC set a limit on incentives under wellness programs equal to 30% of the total cost of self-only coverage under the employer’s group health plan. The court found that the EEOC did not properly consider whether the 30% limit on incentives would ensure the program remained “voluntary” as required by the ADA and GINA and sent the regulations back to the EEOC for reconsideration.

In the meantime, to avoid “potentially widespread disruption and confusion” the court decided that the final regulations would remain in place while the EEOC determines how it will proceed (e.g., provide support for its regulations, appeal the decision, or change the regulations). As background, under the ADA, wellness programs that involve a disability-related inquiry or a medical examination must be “voluntary.” Similar requirements exist under GINA when there are requests for an employee’s family medical history (typically as part of a health risk assessment). For years, the EEOC had declined to provide specific guidance on the level of incentive that may be provided under the ADA, and their informal guidance suggested that any incentive could render a program “involuntary.” In 2016, after years of uncertainty on the issue, the agency released rules on wellness incentives that resemble, but do not mirror, the 30% limit established under U.S. Department of Labor (DOL) regulations applicable to health-contingent employer-sponsored wellness programs. While the regulations appeared to be a departure from the EEOC’s previous position on incentives, they were welcomed by employers as providing a level of certainty.

However, the American Association for Retired Persons (AARP) sued the EEOC in 2016, alleging that the final regulations were inconsistent with the meaning of “voluntary” as that term was used in ADA and GINA. AARP asked the court for injunctive relief, which would have prohibited the rule from taking effect in 2017. The court denied AARP’s request in December 2016, finding that AARP failed to demonstrate that its members would suffer irreparable harm from either the ADA or the GINA rule, and that AARP was unlikely to succeed on the merits. This was due in part to the fact that the administrative record was not then available for the court’s review.

In its recent decision, the court reviewed the administrative record and found the EEOC’s regulations were arbitrary and capricious, in that the EEOC failed to provide a reasoned explanation for its decision to interpret the term “voluntary” to permit a 30% incentive level. As part of its analysis, the court evaluated numerous reasons the EEOC gave for choosing the 30% level and noted that, having chosen to define “voluntary” in financial terms (30% of the cost of self-only coverage), the EEOC “does not appear to have considered any factors relevant to the financial and economic impact the rule is likely to have on individuals who will be affected by the rule.”

The court has allowed the final regulations to remain in place while the EEOC determines how it will proceed, to avoid disruption to employers and others who have relied on them. If the court had vacated the regulations, employers would have been at risk of violating the ADA despite having designed their wellness programs to comply with the 30% limit on incentives.

Next Steps and Impact on Employers

It is unknown at this time how the EEOC will respond to the court’s decision. If the EEOC wishes to continue its application of the rule, it will need to supplement the administrative record with some evidence that participation in a wellness program remains “voluntary” even when an employer can penalize employees 30% of the total cost of coverage if they don’t participate. However, the EEOC may decide, instead, to withdraw its rule or promulgate new rules lowering the incentive limit (further distancing it from the HIPAA limits). It is likely that any new rules would provide for a transition period during which employers would be able to review and revise their wellness programs so that they comply. Given that the Trump Administration’s nomination for EEOC Commission Chair awaits Senate confirmation, it may be a considerable amount of time until the EEOC decides how to proceed, leaving employers without the clarity they desire on this issue.

It is also possible, though given other priorities unlikely, that Congress may intervene to pass legislation harmonizing the ADA with the HIPAA/ACA rules, which would render the court’s decision moot.

In the short term, employers may continue to rely on the EEOC’s final regulations. Wellness programs designed to comply with existing rules, specifically the 30% cap, are unlikely to be challenged by the federal governmental agencies. However, it is possible the court’s decision may open the door for employees to bring a private lawsuit against an employer challenging under the ADA the “voluntariness” of a wellness program that includes an incentive up to the 30% limit. One would expect that any employer facing such an action would defend it arguing its good faith reliance on the EEOC’s regulation.

In the longer term, employers are again faced with uncertainty as to their wellness program incentives. Employers designing and maintaining wellness programs should continue to monitor developments and work with employee benefits counsel to ensure their wellness programs comply with all applicable laws.

Click here to download this month’s Wellness Newsletter. This month’s edition contains articles on Walking for Wellness, 6 Ways To Get Organized And Stop Putting Things Off, and more!

Senate Rejects ACA Repeal Efforts

In the early morning hours of July 28, 2017, members of the U.S. Senate voted 49-51 to reject a “skinny” version of a bill to repeal and replace the Affordable Care Act (ACA), called the Health Care Freedom Act (HCFA).

This was the final vote of the Senate’s 20-hour debate period, and effectively ended the Republicans’ current efforts to repeal and replace the ACA. However, the skinny repeal bill may be reintroduced at some point in the future.

What did the HCFA propose?

Similar to the American Health Care Act and the Better Care Reconciliation Act, the HCFA would repeal the ACA’s individual and employer mandate penalties, effective Dec. 31, 2015. However, the employer mandate repeal would only be effective through 2024.

In addition, the ACA’s reporting requirements under Sections 6055 and 6056 would remain intact.

The HCFA would have also:

- Extended the moratorium on the medical devices excise tax.

- Increased the contribution limit for health savings accounts up to the maximum out-of-pocket limits allowed by law for high deductible health plans.

- Amended the ACA’s existing Section 1332 State Innovation Waivers, added stricter requirements for the Department of Health and Human Services in approving waivers, and extended waivers to eight years (instead of five), with unlimited renewals.

What are the next steps for employers?

Because the Senate was unable to pass any ACA repeal or replacement bill, the ACA remains current law, and employers must continue to comply with all applicable ACA provisions.

Following the vote, Senate Majority Leader Mitch McConnell indicated that Republicans now intend to focus on other legislative issues, although they remain committed to repealing the ACA.

Updated Form I-9 Required Beginning Sept. 18

On July 17, 2017, U.S. Citizenship and Immigration Services (USCIS), part of the U.S. Department of Homeland Security, issued an updated version of Form I-9: Employment Eligibility Verification (Form I-9). Under federal law, every employer that recruits, refers for a fee or hires an individual for employment in the United States must complete a Form I-9.

The updated form replaces a version that was issued in 2016. Employers may continue using the 2016 form until Sept. 17, 2017. Exclusive use of the updated form is expected by Sept. 18, 2017. The new form expires on Aug. 31, 2019.

The updated Form I-9 includes revisions to the instructions and to the list of acceptable documents, but does not include substantive revisions for completing the Form I-9. Visit the USCIS website for more information regarding USCIS or the new Form I-9.

On July 28, 2017, the Department of Treasury announced that it will be shutting down the my Retirement Account (myRA) program. The program was put in place by former President Barack Obama as a means to help those who did not have access to a retirement account at work to save for retirement.

Jovita Carranza, the United States Treasurer, explained that the program is being discontinued because it cost too much compared to the demand for the accounts.

For more information, please see the Department of Treasury’s myRA press release announcement.