Upcoming ACA Reporting Deadlines

Employers subject to Affordable Care Act (ACA) reporting under Internal Revenue Code Sections 6055 or 6056 should prepare to comply with reporting deadlines in early 2024. For the 2023 calendar year, covered employers must:

- Furnish statements to individuals by March 1, 2024 (an alternative method of furnishing statements to covered individuals is available in certain situations); and

- File returns with the IRS by Feb. 28, 2024, or April 1, 2024, if filing electronically. Beginning in 2024, employers that file at least 10 returns during the calendar year must file electronically.

Penalties may apply if employers are subject to ACA reporting and fail to file returns and furnish statements by the applicable deadlines.

Individual statements for 2023 must be furnished within 30 days of Jan. 31, 2024. Because 2024 is a leap year, the deadline for individual statements is March 1, 2024. In addition, electronic IRS returns for 2023 must be filed by March 31, 2024. However, since this is a Sunday, electronic returns must be filed by the next business day, which is April 1, 2024.

Covered Employees

The following employers are subject to ACA reporting under Sections 6055 and 6056:

- Employers with self-insured health plans (Section 6055 reporting)

- Applicable large employers (ALEs) with either fully insured or self-insured health plans (Section 6056 reporting)

ALEs are employers with 50 or more full-time employees (including full-time equivalent employees) during the preceding calendar year. Note that ALEs with self-funded plans are required to comply with both reporting obligations. However, to simplify the reporting process, the IRS allows ALEs with self-insured plans to use a single combined form to report the information required under both Sections 6055 and 6056.

Section 6055 and 6056 Reporting

- Section 6055 applies to providers of minimum essential coverage (MEC), such as health insurance issuers and employers with self-insured health plans. These entities generally use Forms 1094-B and 1095-B to report information about the coverage they provided during the previous year.

- Section 6056 applies to ALEs—generally, those employers with 50 or more full-time employees, including full-time equivalents, in the previous year. ALEs use Forms 1094-C and 1095-C to report information relating to the health coverage that they offer (or do not offer) to their full-time employees.

Employers reporting under both Sections 6055 and 6056—specifically, ALEs with self-insured plans—use a combined reporting method by filing Forms 1094-C and 1095-C.

Annual Deadlines

Generally, forms must be filed with the IRS annually, no later than Feb. 28 (March 31, if filed electronically) of the year following the calendar year to which the return relates. Employers may receive an automatic 30-day extension to file with the IRS by completing and filing Form 8809 by the due date of the return. Additional extensions of time to file may also be available under certain hardship conditions.

In addition, a reporting entity must furnish statements annually to each individual who is provided MEC (under Section 6055) and each of the ALE’s full-time employees (under Section 6056). Individual statements were generally due on or before Jan. 31 of the year immediately following the calendar year to which the statements relate. However, beginning with the 2021 calendar year, the IRS has provided an automatic extension of 30 days to furnish statements (Forms 1095-B and 1095-C) to individuals under Sections 6055 and 6056. Because the extension is automatic, reporting entities do not need to formally request an extension from the IRS.

Under this deadline extension, statements furnished to individuals will be timely if furnished no later than 30 days after Jan. 31 of the year following the calendar year to which the statement relates. If the extended furnishing date falls on a weekend or legal holiday, statements will be timely if furnished on the next business day.

Alternative Method of Furnishing Under Section 6055

As of 2019, the individual mandate penalty has been reduced to zero. As a result, an individual does not need the information on Form 1095-B to calculate their federal tax liability or file a federal income tax return. Beginning with the 2021 calendar year, the IRS has provided an alternative manner for a reporting entity to furnish statements to individuals under Section 6055. This alternative method applies for all years when the individual mandate penalty is zero.

Under this alternative manner of furnishing, the reporting entity must post a clear and conspicuous notice on its website stating that responsible individuals may receive a copy of their statement upon request. The notice must include an email address, a physical address to which a request may be sent and a telephone number to contact the reporting entity with any questions. Reporting entities must post the notice by the due date for furnishing ACA statements and must generally retain the website notice until Oct. 15.

ALEs offering self-insured health plans are generally required to use Form 1095-C, Part III, to meet the Section 6055 reporting requirements, instead of Form 1095-B. A self-insured ALE may use this relief for employees who are enrolled in the ALE’s self-insured plan and are not full- time employees of the ALE, as well as for nonemployees (e.g., former employees) who are enrolled in the self-insured plan. However, an ALE may not use the alternative method of furnishing for full-time employees who are enrolled in the self-insured plan.

New Electronic Filing Threshold

There is a new electronic filing threshold for information returns required to be filed on or after Jan. 1, 2024, which has been decreased to 10 or more returns (originally, the threshold, the instructions for 2023 returns (filed in 2024) owing clarifications and reminders:

- The 10-or-more requirement applies in the aggregate to certain information returns. Accordingly, a reporting entity may be required to file fewer than 10 of the applicable Form 1094 and 1095, but still have an electronic filing obligation based on other kinds of information returns filed (e.g., Forms W-2 and 1099).

- The electronic filing requirement does not apply to those reporting entities that request and receive a hardship waiver; however, the IRS encourages electronic filing even if a reporting entity is filing fewer than 10 returns.

- The formatting directions in the instructions are for the preparation of paper returns. When filing forms electronically, the formatting set forth in the “XML Schemas” and “Business Rules” published on IRS.gov must be followed rather than the formatting directions in the instructions. For more information regarding electronic filing, see IRS Publications 5164 and 5165.

IRS Announces Employee Benefit Plan Limits for 2024

Many employee benefits are subject to annual dollar limits that are updated for inflation before the beginning of each calendar year. Most of these annual dollar limits will increase in 2024. Note that some benefit limits are not adjusted for inflation, such as the contribution limit for dependent care flexible spending accounts (FSAs) and the catch-up contribution limit for health savings accounts (HSAs).

Employers should confirm that payroll systems are updated for the 2024 limits and that the new limits are communicated to employees. The following benefit limits apply for 2024:

HSA Contributions

- Single coverage: $4,150 (up $300 from 2023)

- Family coverage: $8,300 (up $550 from 2023)

- Catch-up contributions: $1,000 (not adjusted for inflation)

Health FSA Limits

- Employee pre-tax contributions: $3,200 (up $150 from 2023)

- Carryover of unused funds: $640 (up $30 from 2023)

Dependent Care FSA Contributions

- $5,000 or $2,500 if married and filing taxes separately (not adjusted for inflation)

401(k) Contributions

- Employee elective deferrals (pre-tax and Roth contributions): $23,000 (up $500 from 2023)

- Catch-up contributions: $7,500 (no change from 2023)

Transportation Fringe Benefits

- Monthly limits: $315 (up $15 from 2023)

Live Well Work Well Holiday Stress

Cost-sharing Limits for 2025 Released

On Nov. 15, 2023, the Centers for Medicare and Medicaid Services (CMS) released the maximum limits on cost sharing for 2025 under the Affordable Care Act (ACA). For 2025, the maximum annual limitation on cost sharing is $9,200 for self-only coverage and $18,400 for family coverage. This represents an approximately 2.6% decrease from the 2024 limits of $9,450 for self-only coverage and $18,900 for family coverage.

The ACA requires most health plans to comply with annual limits on total enrollee cost sharing for essential health benefits (EHBs). These cost-sharing limits are commonly referred to as an out-of-pocket maximum. Once the out-of-pocket maximum is reached for the year, the enrollee cannot be responsible for additional cost-sharing for EHBs for the remainder of the year.

Any out-of-pocket expenses required by or on behalf of an enrollee with respect to EHBs must count toward the cost-sharing limit. This includes deductibles, copayments, coinsurance and similar charges but excludes premiums and spending for noncovered services. Health plans that use provider networks are not required to count an enrollee’s expenses for out-of-network benefits toward the cost-sharing limit.

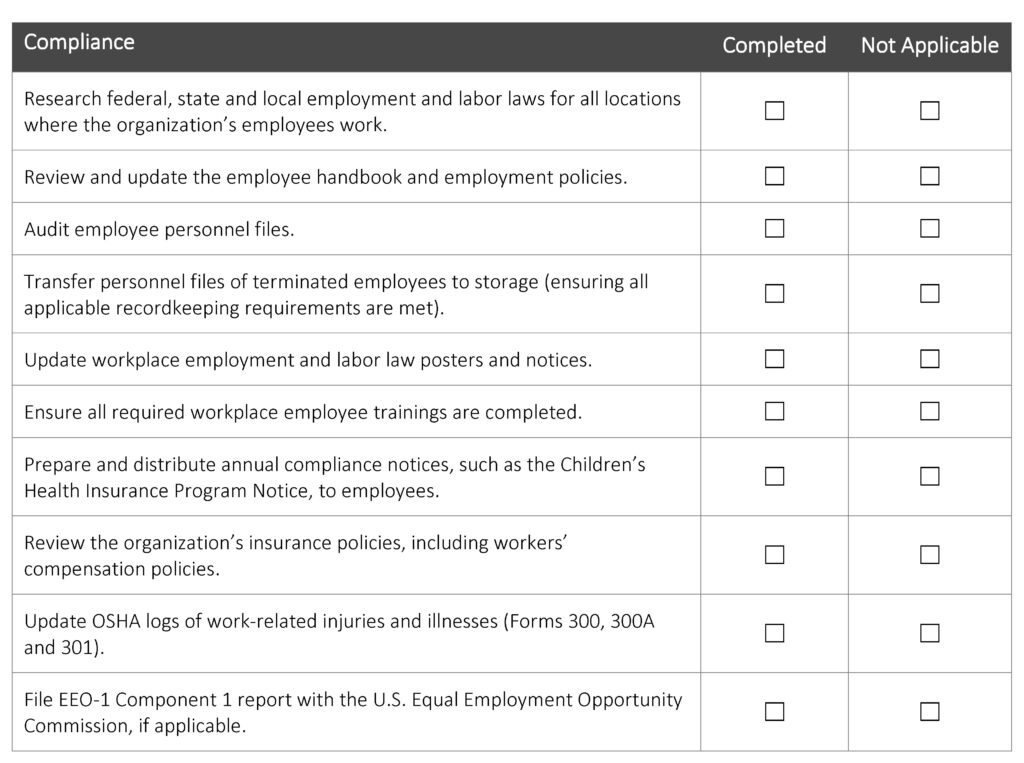

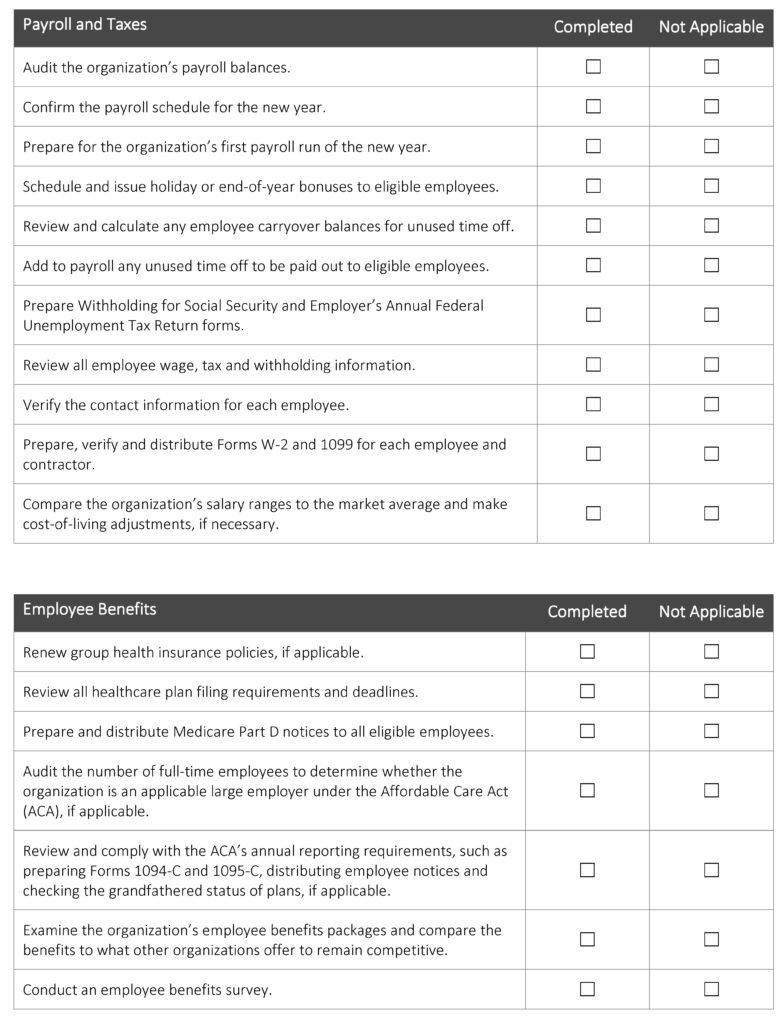

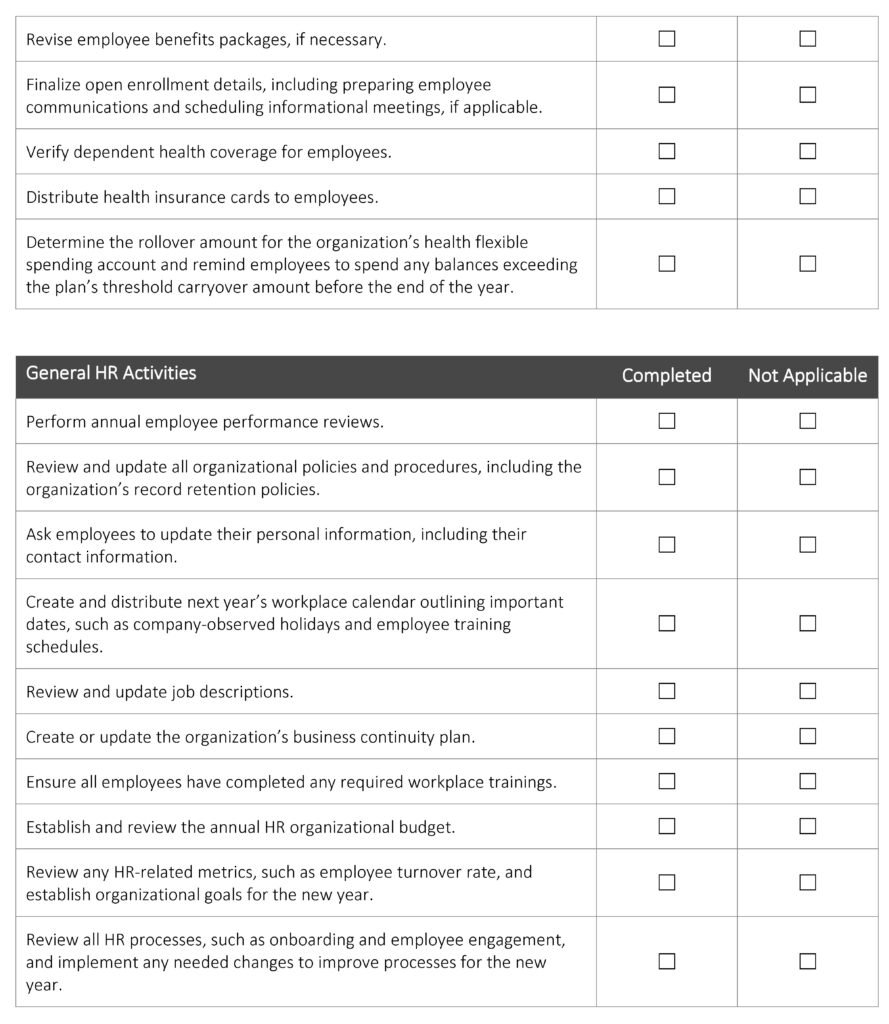

Year - End Activity Checklist

The end of the year is usually an extremely busy time for HR professionals. There’s a lot they must do in a relatively short time period to close out the year and prepare for the upcoming one. A smooth and effective year-end process can help ensure HR professionals comply with relevant laws and regulations and that necessary tasks are completed in an orderly manner. This checklist can assist HR professionals like you in developing and maintaining an effective year-end process and outlines key activities to consider completing before the end of the year.

The following checklist is not an all-encompassing year-end list but rather an overview of common HR activities. This checklist is intended to be used as a guide, and the steps in this list should be modified to meet the unique needs of your organization. Due to the complexities and legal requirements of some of these activities, employers are encouraged to seek legal counsel to address specific issues and concerns.

Year-end activities can seem endless, leaving many HR professionals feeling overwhelmed. Preparing early can help you wrap up this year properly and set your organization up for success next year. Establishing a formal year-end process can improve operational and administrative efficiency to save your organization time and money and reduce potential legal liabilities.

For assistance with year-end planning, contact HealthSure today.