Deadline Approaching: Medicare Part D Notices Are Due Before Oct. 15

IRS Confirms ACA Pay or Play Penalties Still Apply

Employers Are Expected to Spend More on Health Care and Wellness in the Next Year

Key HSA Features – 2020 Compliance

Deadline Approaching: Medicare Part D Notices Are Due Before Oct. 15

Each year, Medicare Part D requires group health plan sponsors to disclose to individuals who are eligible for Medicare Part D and to the Centers for Medicare and Medicaid Services (CMS) whether the health plan’s prescription drug coverage is creditable. Plan sponsors must provide the annual disclosure notice to Medicare-eligible individuals before Oct. 15, 2019.

What is this notice?

This notice is important because Medicare beneficiaries who are not covered by creditable prescription drug coverage and do not enroll in Medicare Part D when first eligible will likely pay higher premiums if they enroll at a later date. Although there are no specific penalties associated with this notice requirement, failing to provide the notice may be detrimental to employees.

What do employers need to do?

Employers should confirm whether their health plans’ prescription drug coverage is creditable or non-creditable and prepare to send their Medicare Part D disclosure notices before Oct. 15, 2019. To make the process easier, employers often include Medicare Part D notices in open enrollment packets.

Resources

CMS has provided model disclosure notices for employers to use. Employers are not required to use the model notices from CMS. However, if the model language is not used, a plan sponsor’s notices must include certain information, including a disclosure about whether the plan’s coverage is creditable and explanations of the meaning of creditable coverage and why creditable coverage is important.

IRS Confirms ACA Pay or Play Penalties Still Apply

Employers Are Expected to Spend More on Health Care and Wellness in the Next Year

According to Optum’s Wellness in the Workplace study, more than 80% of employers plan to spend more on health care and wellness in the next year than in previous years.

Health Care Spending

The cost of providing employer-sponsored health care has been steadily increasing over the years. According to the Kaiser Family Foundation, the average health insurance premium for family coverage was $19,616 in 2018, with employers paying 71% of that cost. Premiums are expected to continue to increase, which means employer health care spending will increase too.

Wellness Spending

To mitigate rising health care costs, improve attraction and retention, and increase employee well-being, many employers plan to spend more on wellness initiatives in the upcoming year. Specifically, employers plan to focus on mental health initiatives and disease management.

For resources on wellness initiatives or mitigating health care costs, contact HealthSure today.

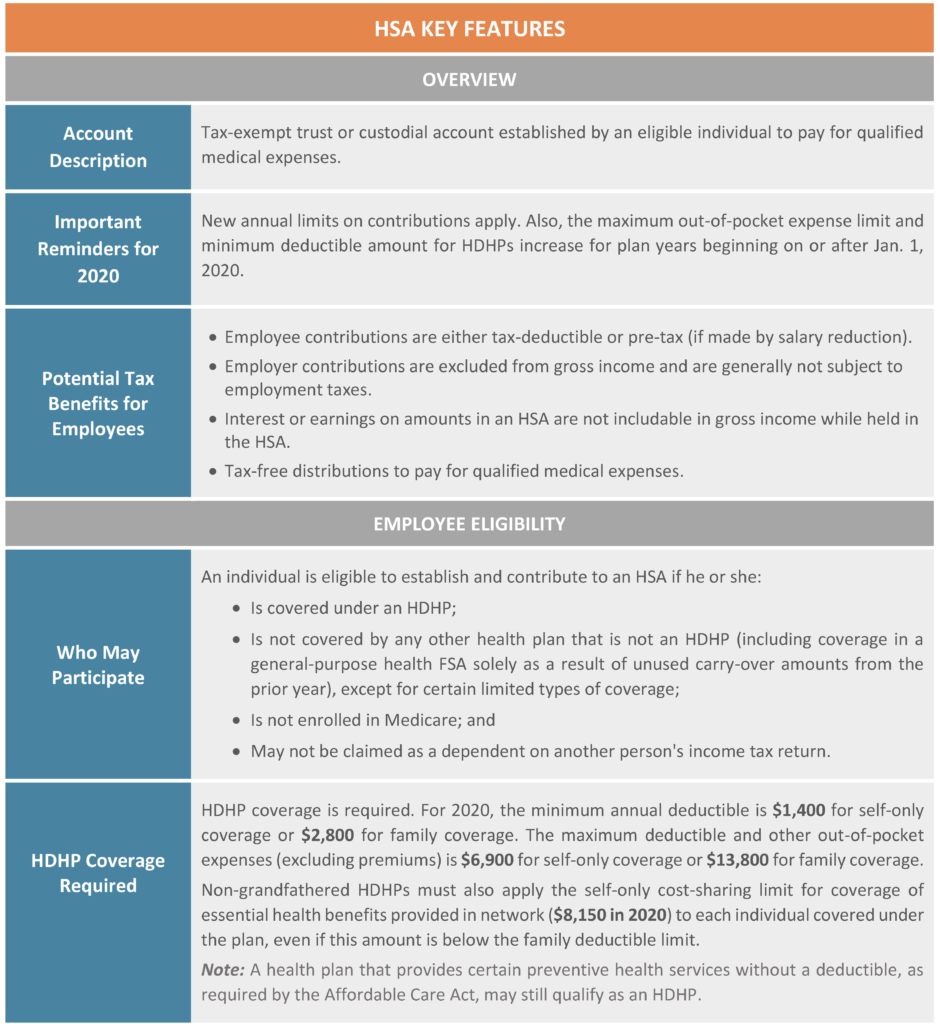

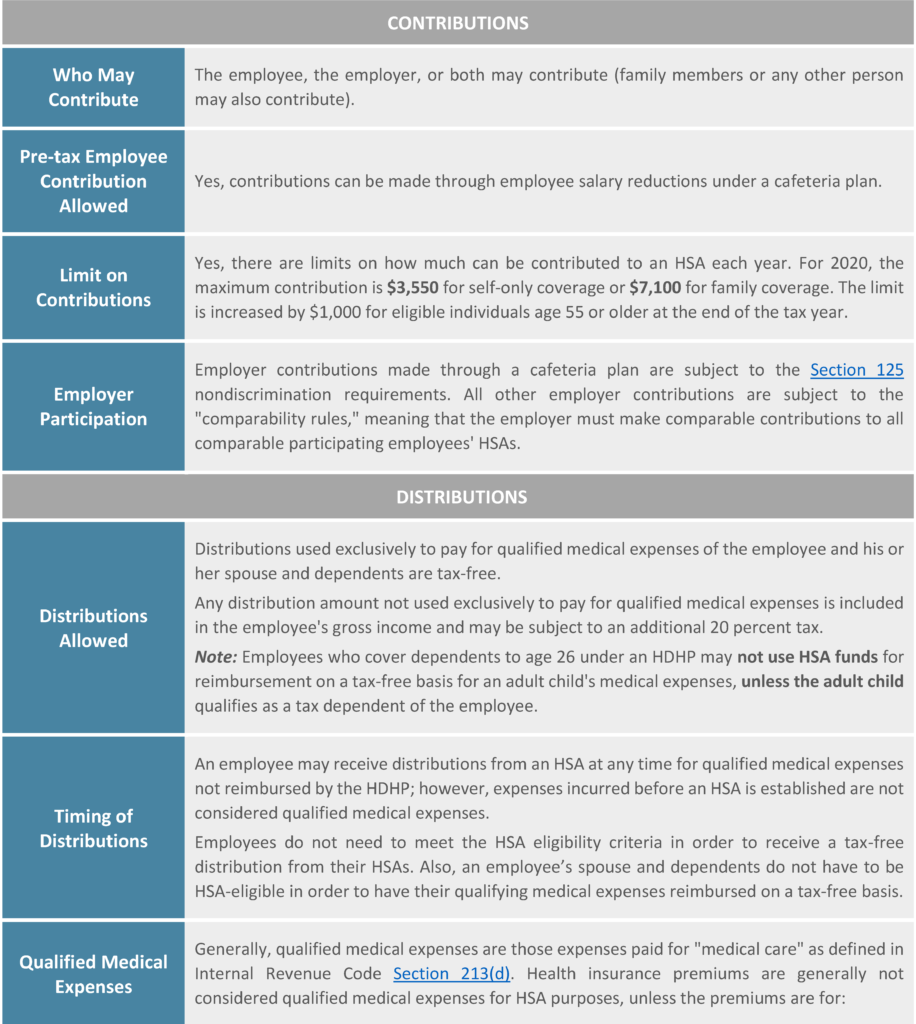

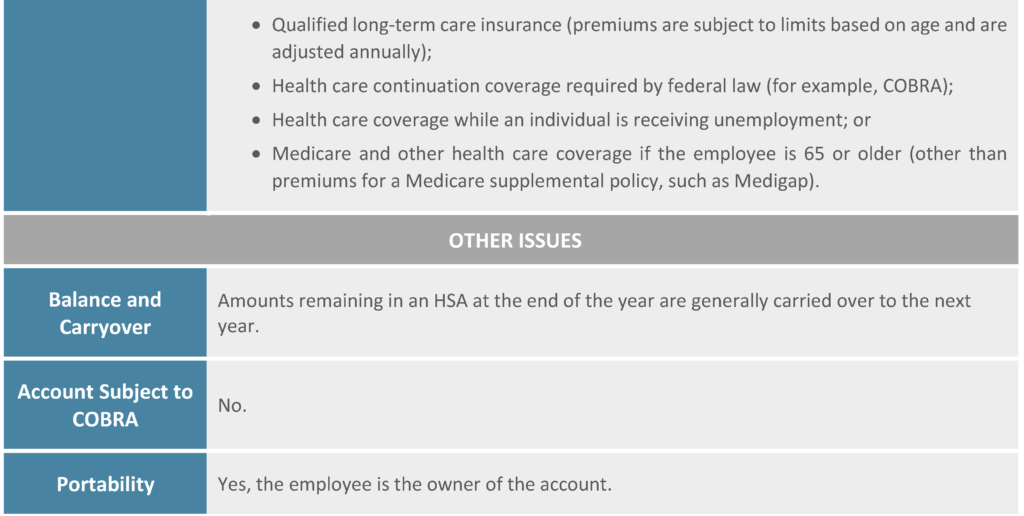

Health savings accounts (HSAs) are a popular type of tax-advantaged medical savings account available to individuals enrolled in high deductible health plans (HDHPs). Individuals can use their HSAs to pay for expenses covered under the HDHP until their deductible has been met, or they can use their HSAs to pay for qualified medical expenses that are not covered under the HDHP, such as dental or vision expenses.

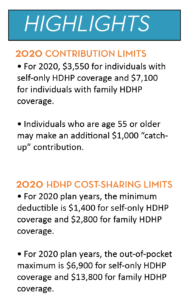

HSAs provide a triple tax advantage—contributions, interest and earnings, and amounts distributed for qualified medical expenses are all exempt from federal income tax, Social Security/Medicare tax and most state income taxes. Due to an HSA’s potential tax savings, federal tax law includes strict rules for HSAs, including limits on annual contributions and HDHP cost sharing.

This Compliance Overview summarizes key features for HSAs, including the contribution limits for 2020.

LINKS AND RESOURCES

- IRS Publication 969, Health Savings Accounts and Other Tax-favored Health Plans.

- IRS Rev. Proc. 2019-25, which includes the inflation-adjusted HSA limits for 2020.