HHS Proposes Revisions to ACA Section 1557 Regulations

IRS Releases 2020 HSA Contribution Limits and HDHP Deductible and Out-of-Pocket Limits

REMINDER: PCORI Fees Due By July 31, 2019

New Bipartisan Bill Aimed at Reducing Health Care Costs Proposed

HHS Proposes Revisions to ACA Section 1557 Regulations

At the end of May, the Department of Health and Human Services (HHS) released a proposed rule to revise regulations previously released under Section 1557 of the Affordable Care Act (ACA). The HHS goal with the proposed rule is to remove what the department views as redundancies and inconsistencies with other laws, as well as reduce confusion.

Changes in Compliance with Section 1557 Proposed Rule

ACA Section 1557 applies to “covered entities” – i.e., health programs or activities that receive “federal funding” from HHS (except Medicare Part B payments), including state and federal Marketplaces. Examples include hospitals, health clinics, community health centers, group health plans, health insurance issuers, physician’s practices, nursing facilities, etc.

Under current rules, “covered entities” include employers with respect to their own employee health benefit programs if the employer is principally engaged in providing or administering health programs or activities (i.e., hospitals, physician practices, etc.), or the employer receives federal funds to fund the employer’s health benefit program. Group health plans themselves are subject to the rule if they receive federal funds from HHS (e.g., Medicare Part D Subsidies, Medicare Advantage). In other words, employers who aren’t principally engaged in providing health care or health coverage generally aren’t subject to these rules directly unless they sponsor an employee health benefit program that receives federal funding through HHS, such as a retiree medical plan that participates in the Medicare Part D retiree drug subsidy program.

The most prominent proposed change is to the provision in Section 1557 which provides protections against discrimination on the basis of race, color, national origin, sex, age, and disability in certain health programs or activities. HHS’ proposed regulation would revise the definition of discrimination “on the basis of sex” that currently includes termination of pregnancy, sex stereotyping, and gender identity. The proposed rule, if finalized, would remove gender identity, stereotyping, and pregnancy termination as protected categories under Section 1557—though they will remain protected under other civil rights laws and regulations.

Certain compliance requirements on covered entities will also change, including the narrowing the scope of who Section 1557 regulates. Entities not principally engaged in healthcare will be subject to Section 1557 only to the extent they are funded by HHS. Entities whose primary business is providing healthcare will also be regulated if they receive federal financial assistance. A “health program or activity” specifically would not include employee benefit programs, including short-term plans and self-funded ERISA plans as long as they do not receive funding from HHS. The proposed rule also regulates insurance carriers only with respect to products for which the carrier receives federal financial assistance; the current rule regulates all products if the carrier received federal funding for at least one product.

Additionally, more flexible standards concerning individuals with limited English proficiency are proposed, including revising the “tagline” requirement. The tagline requirement requires distributing certain notices in 15 different languages in every “significant” publication associated with a health plan (anything larger than a brochure or postcard). HHS views this requirement as being too costly without data to back up that the taglines are beneficial. If the proposed rule is finalized, the tagline requirement will be eliminated.

Although there are provisions and definitions that will be changed or eliminated, parts of Section 1557 will remain intact. Likewise, HHS expects other agencies and departments to oversee and enforce nondiscrimination laws that will no longer be under HHS purview.

What to Expect Next

HHS is required to allow public comments of the proposed rule until approximately July 23, 2019. Once public commenting is closed and considered, HHS will likely release a final rule with answers to certain comments unless there are major changes to the proposed rule.

Until the proposed rule is finalized, employers who are covered entities (or whose plans are covered entities) should continue to treat termination of pregnancy, sex stereotyping, and gender identity as protected categories in relation to health programs and activities. Likewise, all other areas of Section 1557 should continue to be followed, including who is regulated and the tagline requirement. States and localities may give greater protections so it is important to keep in mind that there may be further requirements under those local laws and regulations.

IRS Releases 2020 HSA Contribution Limits and HDHP Deductible and Out-of-Pocket Limits

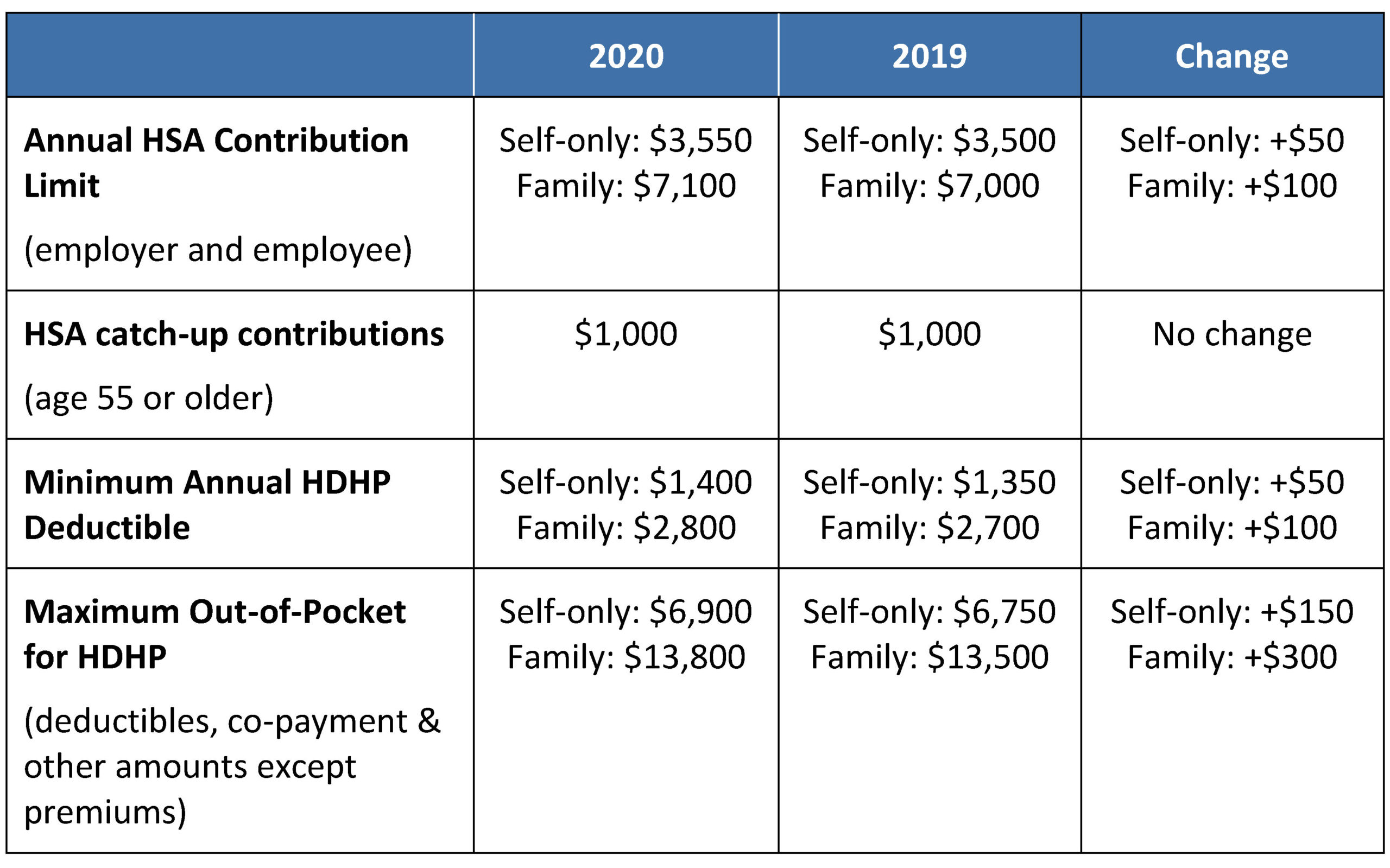

In Rev. Proc. 2019-25, the IRS released the inflation adjusted amounts for 2020 relevant to HSAs and high deductible health plans (HDHPs). The table below summarizes those adjustments and other applicable limits.

Out-of-Pocket Limits Applicable to Non-Grandfathered Plans

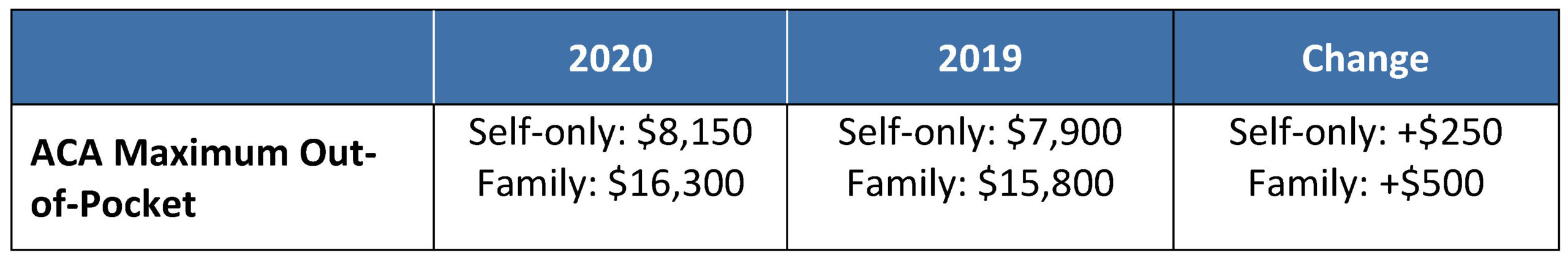

The ACA’s out-of-pocket limits for in-network essential health benefits have also been announced and have increased for 2020.

Note that all non-grandfathered group health plans must contain an embedded individual out-of-pocket limit within family coverage, if the family out-of-pocket limit is above $8,150 (2020 plan years) or $7,900 (2019 plan years). Exceptions to the ACA’s out-of-pocket limit rule are available for certain small group plans eligible for transition relief (referred to as “Grandmothered” plans). A one-year extension of transition relief was recently announced extending the transition relief to policy years beginning on or before October 1, 2020, provided that all policies end by December 31, 2020.

Next Steps for Employers

As employers prepare for the 2020 plan year, they should keep in mind the following rules and ensure that any plan materials and participant communications reflect the new limits:

- HDHPs cannot have an embedded family deductible that is lower than the minimum HDHP family deductible of $2,800.

- The out-of-pocket maximum for family coverage for an HDHP cannot be higher than $13,800.

- All non-grandfathered plans (whether HDHP or non-HDHP) must cap out-of-pocket spending at $8,150 for any covered person. A family plan with an out-of-pocket maximum in excess of $8,150 can satisfy this rule by embedding an individual out-of-pocket maximum in the plan that is no higher than $8,150. This means that for the 2020 plan year, an HDHP subject to the ACA out-of-pocket limit rules may have a $6,900 (self-only)/$13,800 (family) out-of-pocket limit (and be HSA-compliant) so long as there is an embedded individual out-of-pocket limit in the family tier no greater than $8,150 (so that it is also ACA-compliant).

REMINDER: PCORI Fees Due By July 31, 2019

Employers that sponsor self-insured group health plans, including health reimbursement arrangements (HRAs) should keep in mind the upcoming July 31, 2019 deadline for paying fees that fund the Patient-Centered Outcomes Research Institute (PCORI). As background, the PCORI was established as part of the Affordable Care Act (ACA) to conduct research to evaluate the effectiveness of medical treatments, procedures and strategies that treat, manage, diagnose or prevent illness or injury. Under the ACA, most employer sponsors and insurers will be required to pay PCORI fees until 2019 (the fee does not apply to plan years ending on or after October 1, 2019). For employers with calendar year plans, this July’s payment will be their final PCORI filing.

The amount of PCORI fees due by employer sponsors and insurers is based upon the number of covered lives under each “applicable self-insured health plan” and “specified health insurance policy” (as defined by regulations) and the plan or policy year end date. This year, employers will pay the fee for plan years ending in 2018.

- For plan years that ended between January 1, 2018 and September 30, 2018, the fee is $2.39 per covered life and is due by July 31, 2019.

- For plan years that ended between October 1, 2018 and December 31, 2018, the fee is $2.45 per covered life and is due by July 31, 2019.

For example, a plan year that ran from July 1, 2017 through June 30, 2018 will pay a fee of $2.39 per covered life. Calendar year 2018 plans will pay a fee of $2.45 per covered life.

NOTE: The insurance carrier is responsible for paying the PCORI fee on behalf of a fully insured plan. The employer is responsible for paying the fee on behalf of a self-insured plan, including an HRA. In general, health FSAs are not subject to the PCORI fee.

Employers that sponsor self-insured group health plans must report and pay PCORI fees using IRS Form 720, Quarterly Federal Excise Tax Return. If this is the employer’s last PCORI payment and they do not expect to owe excise taxes that are reportable on Form 720 in future quarters, they may check the “final return” box above Part I of Form 720.

Note that because the PCORI fee is assessed on the plan sponsor of a self-insured plan, it generally should not be included in the premium equivalent rate that is developed for self-insured plans if the plan includes employee contributions. However, an employer’s payment of PCORI fees is tax deductible as an ordinary and necessary business expense.

Historical Information for Prior Years

- For plan years that ended between October 1, 2017 and December 31, 2017, the fee is $2.39 per covered life and is due by July 31, 2018.

- For plan years that ended between January 1, 2017 and September 30, 2017, the fee is $2.26 per covered life and is due by July 31, 2018.

- For plan years that ended between October 1, 2016 and December 31, 2016, the fee is $2.26 per covered life and was due by July 31, 2017.

- For plan years that ended between January 1, 2016 and September 30, 2016, the fee is $2.17 per covered life and was due by July 31, 2017.

- For plan years that ended between October 1, 2015 and December 31, 2015, the fee was $2.17 per covered life and was due by August 1, 2016.

- For plan years that ended between January 1, 2015 and September 30, 2015, the fee was $2.08 per covered life and was due by August 1, 2016.

- For plan years that ended between October 1, 2014 and December 31, 2014, the fee was $2.08 per covered life and was due by July 31, 2015.

- For plan years that ended between January 1, 2014 and September 30, 2014, the fee was $2 per covered life and was due by July 31, 2015.

- For plan years that ended between October 1, 2013 and December 31, 2013, the fee was $2 per covered life and was due by July 31, 2014.

- For plan years that ended between January 1, 2013 and September 30, 2013, the fee was $1 per covered life and was due by July 31, 2014.

- For plan years that ended between October 1, 2012 and December 31, 2012, the fee was $1 per covered life and was due by July 31, 2013.

Counting Methods for Self-Insured Plans

Plan sponsors may choose from three methods when determining the average number of lives covered by their plans.

Actual Count method. Plan sponsors may calculate the sum of the lives covered for each day in the plan year and then divide that sum by the number of days in the year.

Snapshot method. Plan sponsors may calculate the sum of the lives covered on one date in each quarter of the year (or an equal number of dates in each quarter) and then divide that number by the number of days on which a count was made. The number of lives covered on any one day may be determined by counting the actual number of lives covered on that day or by treating those with self-only coverage as one life and those with coverage other than self-only as 2.35 lives (the “Snapshot Factor method”).

Form 5500 method. Sponsors of plans offering self-only coverage may add the number of employees covered at the beginning of the plan year to the number of employees covered at the end of the plan year, in each case as reported on Form 5500, and divide by 2. For plans that offer more than self-only coverage, sponsors may simply add the number of employees covered at the beginning of the plan year to the number of employees covered at the end of the plan year, as reported on Form 5500.

Special rules for HRAs. The plan sponsor of an HRA may treat each participant’s HRA as covering a single covered life for counting purposes, and therefore, the plan sponsor is not required to count any spouse, dependent or other beneficiary of the participant. If the plan sponsor maintains another self-insured health plan with the same plan year, participants in the HRA who also participate in the other self-insured health plan only need to be counted once for purposes of determining the fees applicable to the self-insured plans.

New Bipartisan Bill Aimed at Reducing Health Care Costs Proposed

On Thursday, May 23, 2019, the Senate Health Committee proposed a bipartisan bill called the Lower Health Care Costs Act. This bill sets out to address surprise medical billing, reduce the cost of prescription drugs and the overall cost of delivering health care, and improve transparency.

The proposed bill is the latest move federal officials have taken to address rising health care costs. Earlier this month, the Department of Health and Human Services (HHS) announced a rule that would require drug companies to disclose the price of prescription drugs on TV ads. In addition, President Donald Trump recently delivered a speech in which he laid out a blueprint for combating surprise medical billing.

The Lower Health Care Costs Act has five main components, including:

- Addressing surprise medical bills

- Lowering the cost of prescription drugs

- Improving transparency

- Improving public health

- Improving the exchange of health information

The Senate Health Committee Chairman Sen. Lamar Alexander said that “Republicans and Democrats in the United States Senate have announced this proposal of nearly three dozen specific bipartisan provisions that will reduce the cost of what Americans pay for health care.”

Additionally, bill co-sponsor Sen. Patty Murray explained that the bill focuses on “important issues like surprise medical billing, drug prices, maternal mortality, and vaccine hesitancy,” and that the rare bipartisan effort demonstrates that “we can make progress when both sides are at the table ready to put patients and families first.”

Sen. Lamar Alexander hopes that the Lower Health Care Costs Act will be on the Senate floor for a vote by July of this year. To view the proposal, click here.