IRS Issues Affordability Percentage Adjustment for 2024

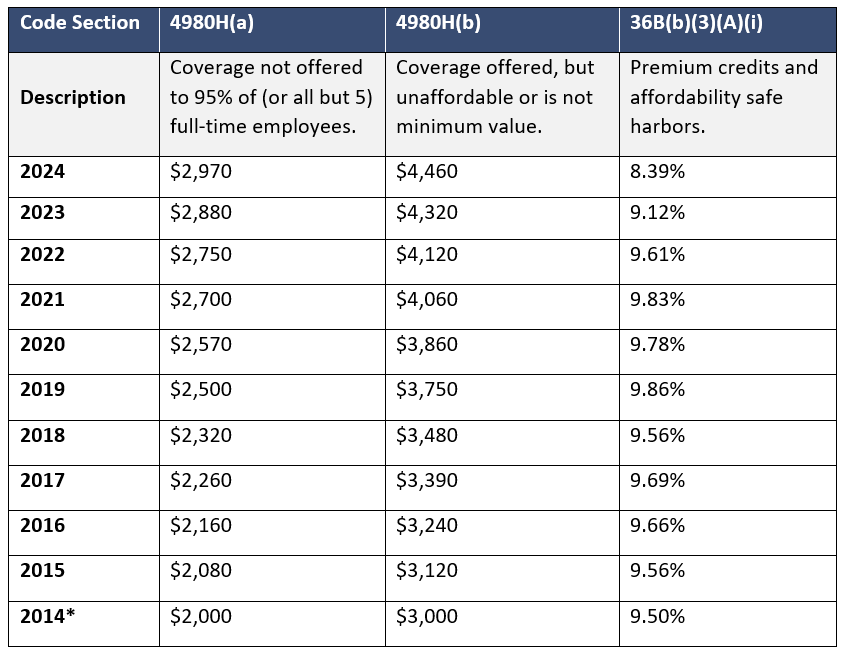

The Internal Revenue Service (IRS) has released Rev. Proc. 2023-29, which contains the inflation-adjusted amounts for 2024 used to determine whether employer-sponsored coverage is “affordable” for purposes of the Affordable Care Act’s (ACA) employer-shared responsibility provisions and premium tax credit program. As shown in the table below, for plan years beginning in 2024, the affordability percentage for employer mandate purposes is indexed to 8.39%. This is a significant decrease from 2023 and the lowest affordability threshold since the Affordable Care Act was implemented. Employer-shared responsibility payments are also indexed.

*No employer-shared responsibility penalties were assessed for 2014.

Under the ACA, applicable large employers (ALEs) must offer affordable health insurance coverage to full-time employees. If the ALE does not offer affordable coverage, it may be subject to an employer-shared responsibility payment. An ALE is an employer that employed 50 or more full-time equivalent employees on average in the prior calendar year. Coverage is considered affordable if the employee’s required contribution for self-only coverage on the employer’s lowest-cost, minimum-value plan does not exceed 8.39% of the employee’s household income in 2024 (prior years shown above). An ALE may rely on one or more safe harbors in determining if coverage is affordable: W-2, Rate of Pay, and Federal Poverty Level.

If the employer’s coverage is not affordable under one of the safe harbors and a full-time employee is approved for a premium tax credit for Marketplace coverage, the employer may be subject to an employer-shared responsibility payment.

Since 2019, the individual mandate penalty imposed on individual taxpayers for failure to have qualifying health coverage was reduced to $0 under the Tax Cuts and Jobs Act, effectively repealing the federal individual mandate. A previous lawsuit challenging the constitutionality of the ACA due to this change to the individual mandate penalty was unsuccessful. The employer mandate has not been repealed and the IRS continues to enforce it through Letter 226J. The IRS is currently enforcing employer-shared responsibility payments for tax years 2020 and 2021.

Next Steps for Employers

This is a significant adjustment in the affordability threshold. Applicable large employers should be aware of the updated, reduced affordability percentage for plan years beginning in 2024, and should consider it along with all other relevant factors when setting contributions.

HealthSure wishes to advise you of the latest development regarding the reporting requirement under the Consolidated Appropriations Act of 2021 as it applies to the prohibition on gag clauses.

Gag Clauses

The Consolidated Appropriations Act, 2021 (CAA) prohibits employer-sponsored group health plans and health insurance issuers, including student health insurance coverage, from entering into agreements that contain “gag clauses.” A “gag clause” is a contractual term that directly or indirectly restricts specific data and information that a plan or issuer can make available to another party.

This prohibition restricts Plans and Issuers from entering into agreements that limit the access to de-identified claims data or the ability to disclose provider-specific information (such as cost and quality information) to certain third parties, including plan participants.

In addition, the CAA added a requirement that each Plan and Issuer annually attest to the absence of gag clauses in its agreements. The prohibition on gag clauses will apply to the network or association of providers, third-party administrators, and other service providers; however, these entities may place reasonable restrictions on the public disclosure of this information (i.e. non-disclosure agreements).

Applicability

The prohibition on gag clauses applies to new or renewing agreements executed on or after December 27, 2020. There is no requirement to amend agreements executed prior to December 27, 2020. Additional guidance is needed from the regulators about whether amendments to a master agreement effective prior to December 27, 2020, would require the removal of any gag clauses.

Reporting

The first Gag Clause Prohibition Compliance Attestation is due no later than December 31, 2023, covering the period beginning December 27, 2020, or the effective date of the applicable group health plan or health insurance coverage (if later), through the date of attestation. Subsequent attestations, covering the period since the last preceding attestation, are due by December 31 of each year thereafter.

Submitting Annual Attestation to CMS

The annual attestation is made through the CMS portal. For more information, please refer to the CMS webpage at Gag Clause Prohibition Compliance Attestation.

- Self-insured group health plans, including ERISA plans, non-Federal governmental plans, and church plans regardless of employer size;

- Health insurance issuers offering group health insurance coverage; and

- Health insurance issuers offering individual health insurance coverage including student health insurance coverage.

These requirements apply to non-grandfathered and grandfathered plans.

Entities required to attest

- Standalone retiree health plans; and

- Excepted benefits, such as dental and vision plans

Deadline for Employers to Receive MLR Rebates Is Approaching

Employers with insured group health plans may soon receive a medical loss ratio (MLR) rebate from their health insurance issuers. Issuers who did not meet the applicable MLR percentage for 2022 must provide rebates to plan sponsors by Sept. 30, 2023. These rebates may be in the form of a premium credit or a lump-sum payment.

The MLR rules require issuers to disclose how much they spend on health care and how much they spend on administrative costs, such as salaries and marketing. If an issuer spends less than 80% (85% in the large group market) of premium dollars on medical care and efforts to improve the quality of care, they must refund the portion of premium that exceeded this limit. Issuers who issue rebates must provide plan sponsors and participants with a notice explaining the rebate and how it was calculated.

Employers who receive MLR rebates should consider their options for using the rebate. Any rebate amount that qualifies as a plan asset under ERISA must be used for the exclusive benefit of the plan’s participants and beneficiaries. In general, employers should use the rebate within three months of receiving it to avoid ERISA’s trust requirement. In addition, employers who receive MLR rebates should be prepared to answer questions from employees about the rebate and how it is being allocated.